New York-based Plug Power raised approximately $150m in at-the-market equity funding in the first quarter of 2024 in an effort to shore up its liquidity.

The cash-burning green hydrogen firm is also in talks with two potential providers of debt that would help extend its runway amid a broader focus on cost reduction.

Plug previously said it would tap the at-the-market equity program to avoid having to issue going concern language, and CFO Paul Middleton said today that they have issued $150m through the program.

But the company’s primary focus is on debt solutions, he said.

“We’ve got a couple parties that we’re closer to that than we’ve ever been under terms that are things that, you know, our biggest challenge today has just been in finding terms that we feel like are meaningful and helpful for us and where we’re going,” Middleton said.

“But these are two parties that we feel extremely well about and have done a lot of diligence to know them very well,” he added, “and we’ll see whether that manifests into conclusion.”

ReSource reported last year that Plug is working with Goldman Sachs to raise debt financing.

Executives said that the company is still awaiting a conditional commitment from the DOE for a project loan, though did not provide additional color on timing.

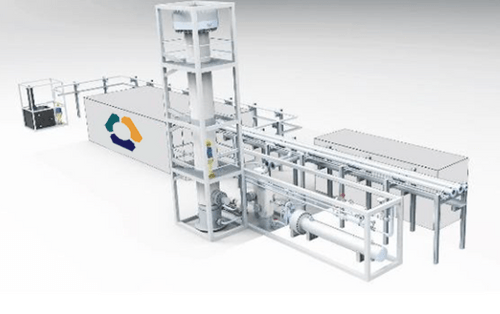

“This program is expected to bolster the buildout of Plug’s liquid hydrogen facilities throughout the United States,” President and CEO Andrew Marsh said on the call.

Marsh added that the company is working with advisors to raise debt and equity that will complement the DOE funding for certain projects.

Plug is reviewing six projects in addition to plants in Georgia, New York, and Texas that are further advanced. The Georgia plant began operations earlier this year, and should help to alleviate Plug’s dependence on more expensive third-party hydrogen sourcing provided to customers.

The company is evaluating locations on the West Coast where it could source hydro power; the middle of the country where it could access low-cost nuclear power; a site further West with solar and wind development; and potentially two more sites in Texas.

“We can obviously always expand our existing footprint and the presence in Georgia as well,” Plug’s Sanjay Shrestha said on the call.