The small Napa Valley city of Calistoga was facing dire straits with its power grid just a few years ago.

The city, known for wineries, mud baths, and hot springs, is considered ground zero for public safety power shutoffs to protect residents during wildfire season.

A temporary solution from Pacific Gas & Electric, the California utility that filed for bankruptcy in 2017 due to wildfire obligations, involved shipping in diesel generators to act as a backup to the grid when power was turned off. The utility issued three requests for proposals for a carbon-free solution before it found what it wanted: a design for the first long-term, clean energy, substation microgrid in its service territory.

“We read the RFP and said, ‘Let’s try to put in front of PG&E something that is unusual – not crazy, unusual,” said Marco Terruzzin, chief commercial and product officer at Energy Vault, a Switzerland-based energy storage developer whose design was selected by PG&E.

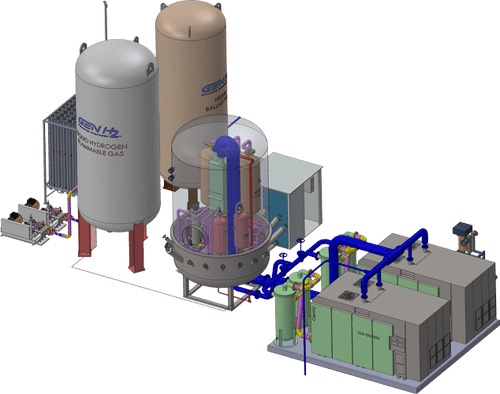

The company is on track to complete construction this summer on the Calistoga Resiliency Center, a system designed to instantly provide 8.5 MW of power for up to 48 hours during public safety power outages.

The California Public Utilities Commission authorized PG&E to spend up to $46m on the project via a 10.5-year tolling agreement, but Terruzin noted that the cost of the project would be less than what was approved. He declined to comment further on the project’s economics.

Energy Vault is financing the project upfront with its balance sheet, but will eventually seek to back-lever the deal with the investment tax credit for standalone storage as well as potential third-party debt and equity investors.

Waiting until the project is commissioned will attract a better interest rate from project finance banks that might be nervous about lending to a first-of-kind project, Terruzin said.

“The interest rate instead of double digits, becomes single digits. And single digit means the project is financially more attractive also for potentially equity holders,” Terruzin said.

The project will receive the 30% ITC plus the 10% boost for domestic content, Garrofo said, and the firm will eventually monetize the credits in the transferability market.

“There is no urgency to sell the ITC this year, but if somebody pays 97 cents on the dollar, I would say that that is a no brainer,” he said. “Better to sell the ITC now.”

Target market

Terruzin acknowledges that the overall market for this sort of asset is not nearly as big as the battery energy storage market. But Energy Vault is still planning to sell the product to the wider public safety power shutoff market as well as to potential industrial end users and airports, Terruzin said.

“California, East Coast and also Colorado, there are some communities that are not willing to discuss the carbon intensity of the solution,” he said. “They want something that is not smelly, something that is not associated with fossil fuels, something that can stay there for 10, 20 years.”

At airports, due to issues connecting to the grid, car rental companies are looking for off-grid DC fast-charging solutions for electric vehicles, Terruzin said. And Energy Vault is preparing to launch a new product targeting this specific market.

“We’ll have liquid hydrogen providing 50 MWh of available electricity without any interconnection,” Terruzin said, a bridge solution for the next three to five years while utilities trench and install power to the airport.

Energy Vault met the domestic content requirements under the ITC for the Calistoga project in part because the fuel cells are from Plug Power. Eventually, Terruzin said, China will likely manufacture cheaper fuel cells following trends in the solar and wind industries.

Terruzin added that essential for these projects is the energy management software: Energy Vault worked with NREL to develop a system that amounts to “the secret sauce.”

“You have a bunch of equipment that’s designed to work together but if you don’t have the energy management software that orchestrates between these two or three different technologies to provide the power at the right time,” he said, “it would be worthless.”