A consortium led by Mason Capital Management LLC, in partnership with IES Holdings, Inc., Nut Tree Capital Management, LP, 683 Capital Management, LLC, First Pacific Advisors, and other investors, has entered into a definitive agreement to acquire the CB&I storage solutions business from McDermott International, Ltd.

CB&I is the world’s most technically advanced builder of storage facilities serving customers across the water and wastewater, upstream, downstream, petrochemical and industrial sectors, the company said in a press release.

McDermott acquired CB&I in 2018 and later filed for bankruptcy.

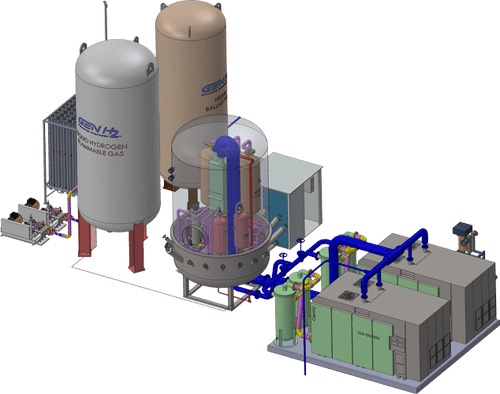

The company delivers products and solutions for critical energy infrastructure projects, including complex low temperature and cryogenic storage systems for LNG, hydrogen, and ammonia. Established in 1889 and headquartered in The Woodlands, Texas, CB&I has more than 4,000 employees and 30 locations across North America, the Middle East, and Asia.

Mark Butts, Senior Vice President of CB&I, and the existing CB&I management team will continue to lead the Company.

Following the close of the transaction, which is being funded with 100% equity, CB&I will have a debt free balance sheet, and has secured a new revolving credit facility that will enable it to better compete for and serve new and existing customers and projects. With substantial liquidity to expand operations, the Company will take advantage of strong current demand for infrastructure and energy projects.

Citi is acting as exclusive Financial Advisor to Mason and is Lead Left Arranger on the new revolving credit facility to support the transaction.

Cadwalader, Wickersham & Taft LLP provided legal counsel to Mason.

Goldman Sachs & Co. LLC is serving as the exclusive financial advisor for the transaction to McDermott, according to a separate press release. Kirkland & Ellis LLP is serving as legal counsel to McDermott.

The transaction is expected to close in the fourth quarter of 2024, subject to customary closing conditions.