IFM Investors via the IFM Net Zero Infrastructure Fund (NZIF) has signed a definitive agreement to acquire a majority interest in GreenGasUSA (GreenGas), a US-based renewable natural gas (RNG) developer, owner and operator, according to a news release.

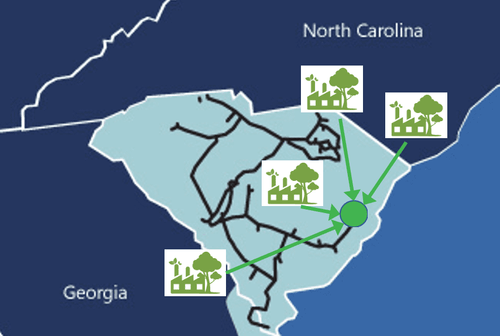

GreenGas is a fully integrated renewables platform headquartered in Charleston, South Carolina with a track record of originating, developing and operating RNG projects. The company utilizes mature technologies to capture, purify and transport biogas from existing organic waste streams for its end use as pipeline quality RNG. GreenGas sells the RNG and associated environmental attributes under long-term offtake contracts with investment grade commercial & industrial customers, such as Mercedes-Benz, Berkshire Hathaway Energy and Duke University.

RNG projects operated by GreenGas can deliver significant emission reductions from waste streams by capturing methane, which has a 25 times more harmful impact on atmospheric warming than CO2 per the Environmental Protection Agency, demonstrating strong alignment with the net zero energy transition.

CEO and Founder Marc Fetten will continue to lead GreenGas alongside the existing management team. The acquisition marks a significant milestone for the company and secures long-term investment capital to expand its footprint of renewable natural gas projects and continue delivering on its mission to help food processors, farmers and industrial manufacturers capture greenhouse gas emissions from their operations.

“Our new partner IFM will be investing in GreenGas as a platform to meet the growing demand for renewable energy solutions across the United States,” said Fetten. “Our projects not only reduce greenhouse gas emissions, but help RNG buyers decarbonize their energy intensive operations. We look forward to working with IFM to grow the platform.”

Launched in 2022, IFM NZIF is an open-ended fund targeting essential infrastructure assets that seek to accelerate the world’s transition to a net-zero emissions economy. GreenGas represents NZIF’s first investment in the low carbon fuels sector, a core target sector of the fund.

“We are excited to welcome GreenGas into the IFM NZIF portfolio and support its next phase of growth,” said Kyle Mangini, global head of infrastructure at IFM Investors. “RNG projects operated by GreenGas can deliver significant emissions reductions, which is well aligned with IFM’s net zero commitments and our purpose to protect & grow the long-term retirement savings of working people.”

Transaction close is targeted for Q1 2023 and subject to customary closing conditions and regulatory approvals. Marathon Capital, LLC acted as exclusive financial advisor to GreenGas on the transaction.