GenH2, a manufacturer and installer of hydrogen liquefaction and liquid hydrogen storage systems, is undergoing a $25m Series A raise and has plans to conduct a Series B within 12 months, CEO Greg Gosnell said in an interview.

Young America Capital is advising GenH2 on the Series A, Gosnell said. Two term sheets from lead investors are expected this week for the Series A, he added.

B Riley will likely be conducting the Series B, which will seek to raise about $100m. The company has raised approximately $24m from four seed investors in the last two-and-a-half years.

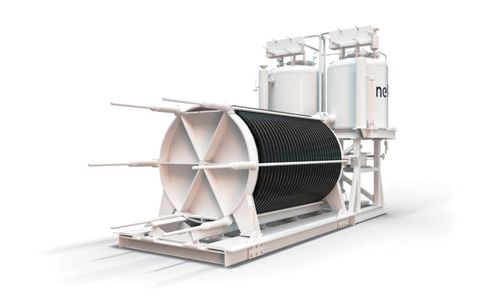

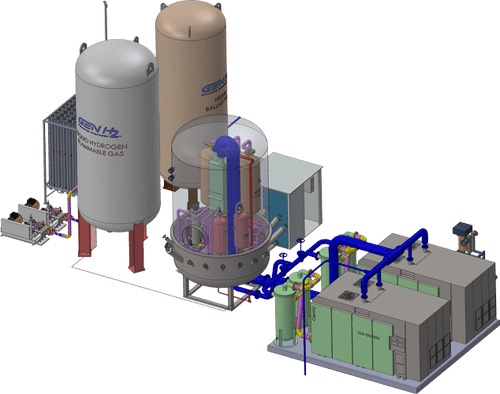

Gosnell projects the company will generate $10.8m in revenues this year, with a “hockey stick” of revenue growth coming in the next two years. The company’s first one-ton-per-day liquefaction and controlled storage solution will roll out at the end of 2Q24. It will have a 5,600 sq ft. footprint.

The company has a partnership with Chart Industries to collaborate on global sales and marketing opportunities, equipment manufacturing and supply, and the deployment of GenH2’s one-ton-per-day liquefier.

Use of funds from the capital raises will predominantly go toward purchasing components and buildout and expansion of manufacturing facilities, Gosnell said. The company has a 35,000 sq. ft. manufacturing facility adjacent to its headquarters in Titusville, Florida, and is considering another location in Texas or Louisiana.

Currently the company, with 46 employees, has closed three contracts on one-ton-per-day liquefaction and storage systems, each between $10m and $12m, Gosnell said. Two additional sales have been made in Australia and Canada for 20-kilogram liquefaction solutions, each $2.2m with credit-worthy customers.

Facilities capacity in Titusville will probably be filled next year. There is space in Titusville to expand more than 100% and the company will option leases for manufacturing.

Going forward the company is interested in strategic partners, Gosnell said. A lot of VC-type investors want to deploy capital in the space but the difficulty is finding an investor confident enough to do the technology due diligence and take the lead.

Easier with liquid

GenH2 installs closed-loop helium-cooled systems of between one and five tons at ports, manufacturing and trucking facilities. The process is done with no liquid nitrogen (LN2), which eliminates the need for truckloads of LN2 or an adjacent LN2 plant.

“Everywhere you see a liquid hydrogen plant today, there’s an LN2 plant next door that’s about five times bigger,” Gosnell said.

GenH2’s liquid hydrogen storage capabilities were demonstrated with NASA, transferring the liquid from multiple tanks with zero loss, he said.

Liquid hydrogen is more energy-dense than compressed gas, bringing down the cost of transportation. In many cases, liquid hydrogen can be dispensed into compressed gas.

“It seems counterintuitive, but if you’re sitting there storing compressed gas at say 100 psi and you need to get to 900 [psi], that’s a lot of work,” Gosnell said. “That’s heavy-duty compression and probably a two-ton chiller.”

Conversely liquid hydrogen wants to become gas, requiring only that you let it vaporize into a smaller tank and it compresses, he said.

“You don’t need any of that work,” he said. “Believe it or not it’s easier to get to a seven or nine-hundred PSI gas with liquid hydrogen than it is from gaseous hydrogen.”

GenH2 is competing against liquid hydrogen delivered in a truck, Gosnell said. He doesn’t know of anyone else doing standalone refrigerated storage with zero transfer loss.

Efficiency is a core focus in design, Gosnell said. Levelized cost with capex and opex all in is between $3 and $3.50 per kilogram for liquifying and storing. With electrolysis or other H2 sourcing on the front end, the company is at $7 or $8 a kilogram, which will improve as renewables are applied.