The South Dakota Public Utilities Commission voted unanimously yesterday to reject an application by BlackRock-backed Navigator CO2 to build a carbon dioxide pipeline through the state.

Commissioners listed several reasons for the permit denial in public remarks yesterday, according to news reports, including a failure by the company to disclose carbon dioxide plume modeling, and a failure to provide timely notices to some landowners along the proposed route.

“While we are disappointed with the recent decision to deny our permit application in South Dakota, our company remains committed to responsible infrastructure development,” a statement from Navigator said. “We will evaluate the written decision of the Public Utilities Commission once issued and determine our course of action in South Dakota thereafter.”

The denial comes on the heels of North Dakota’s rejection last month of another carbon pipeline put forward by Summit Carbon Solutions.

The Navigator CO2 pipeline has faced pushback from residents and local authorities across its footprint.

Proponents previously withdrew an application for eminent domain powers in Illinois after state regulators said the filing was incomplete.The company then announced it would reapply with an expanded route.

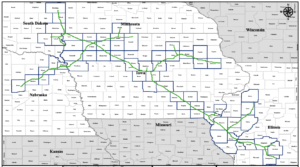

The project scope includes 21 carbon dioxide collection points – at midwestern biofuel plants – along with 1,350 miles of new pipeline and four booster stations across Illinois, Iowa, Minnesota, Nebraska, and South Dakota.

Project costs, including capture and sequestration facilities, are projected at approximately $3.4bn.

The proposed pipeline is contracted with industrial producers to capture, transport, and store up to 10 million metric tons of CO2 annually. When fully expanded, the system will be able to transport up to 15 MMT of CO2 annually, according to documentation.

Construction of the project is expected to commence in 2Q24 pending receipt of regulatory approvals.Equity funding for the project is primarily sourced from BlackRock’s Global Energy & Power Infrastructure Fund III, which has committed equity of $5.1bn.