Talus Renewables is seeking to scale the deployment of its modular green ammonia offering with an additional capital raise.

The start-up is beginning discussions with potential bankers that could advise on a Series B capital raise, as its pipeline grows for distributed ammonia production systems that it can deliver globally, Co-Founder and CEO Hiro Iwanaga said in an interview.

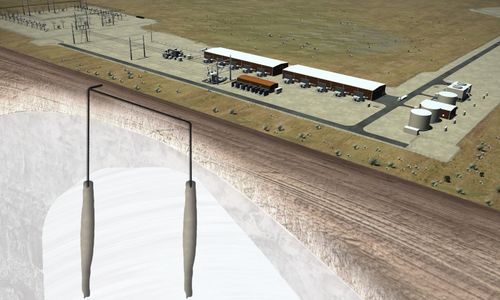

Talus offers containerized systems that produce green ammonia from power, water, and air, in the form of the TalusOne (up to 1.4 tonnes of green ammonia daily) and talusTen (up to 20 tonnes per day).

The company delivered its first system to Kenya Nut Company, a multinational agricultural firm in east Africa, under a 15-year fixed-price ammonia offtake agreement, Iwanaga said. The company has a pipeline of approximately $1bn of indicated interest for ammonia from potential customers, which include large farms and mining companies in several global jurisdictions, including the US.

He declined to comment specifically on how much the company would seek to raise in its next fundraising round, but said, “We have the demand for a $1bn worth of systems.” He added that, though the technology is largely proven, there is a perception of “young company risk” that the firm will need to overcome by delivering and operating its first systems.

Iwanaga, who views the company as a yieldco, required to raise several hundred million dollars every year to deploy its assets, is starting discussions with banks about advisory work for future capital raises.

“I think about our company as an infrastructure company,” he said. “We sign 10- to 15-year-long, fixed-price committed offtake agreements, and these projects earn 10% – 25% unlevered returns.”

A recently completed $22m Series A fundraising will fund the delivery of the next three to four systems before the end of the year, Iwanaga said, stretching Talus’ footprint to Europe and the US, with one more system heading to South America.

The company is deploying to large farms and mining companies, where ammonia is used as a blasting agent. In the US, the company has partnered with agribusiness Wilbur-Ellis and farmer-owned cooperative Landus, Iwanaga said.

Scaling quickly

While many green ammonia projects are popping up around the world, Iwanaga emphasizes that Talus will be able to deliver tons in the next 1 – 2 years, compared to the multi-year project timelines for larger projects requiring more complex supply chains.

“What we’re focused on is improving cost, reliability, and sustainability by driving local production – on-site or near-site production,” Iwanaga said.

Talus has several LOIs for offtake and is working to reach final agreements – work that takes several months at a good site and includes leasing land, permitting, and connecting to power.

The Talus systems are manufactured currently in China, Vietnam, and the US, but the company is moving the majority of its operations out of China and into Vietnam, while some of the Vietnam operations are moving to the US.

The company has partnered with a global auto OEM to lead its manufacturing, which has allowed it to scale quickly.

“Manufacturing a complex, high-temperature, high-pressure gas handling system is very difficult,” he said. “That [OEM] partnership has allowed us to scale in a way that I don’t think very many others have,” he said.