Apex Clean Energy has towering ambitions for green hydrogen production in Texas.

The Charlottesville, Virginia-based renewable energy firm is developing 6.5 GW of renewable generation capacity in West Texas that would support green hydrogen production, ReSource has learned, making it one of the largest projects of its kind in development in North America.

Part of a green hydrogen production, storage, transportation, and export hub known as “Project Rio,” the renewables encompass multiple sites under development in a cluster of counties roughly 200 miles northwest of San Antonio. The planned production sites also include solar and battery storage facilities co-located with electrolyzers.

Under the plan, the green hydrogen produced on site would be transported via a new 500-mile hydrogen pipeline to Corpus Christi, for potential conversion to derivatives like ammonia or methanol and available for domestic end users or export.

If completed as conceived, the scale and complexity of the project would signify an infrastructural magnum opus for Apex and its partners, and a feather in the cap of the power and energy private equity strategy of Ares Management, the owner of both Apex and EPIC Midstream, which operates pipelines running from outside of Corpus Christi through West Texas. The new hydrogen pipeline would likely be built on EPIC’s existing right of way.

Project Rio represents a potential breakthrough in the realm of sustainability, as much for its sheer size as for its project-on-project-on-project schematics and its intention to utilize produced water from nearby oil and gas drilling operations in water-scarce West Texas.

The size and final siting for the project could still change, as some aspects of development are in early stages, a source close to Apex said. However, Apex’s development team in Texas has held meetings with local landowners, with a website for the project noting 5.8 GW of renewables across multiple projects as of October, 2023. The plan, as currently conceptualized, would call for 6.5 GW of renewables, according to several sources.

“This is a revolutionary project – the largest proposed in North America,” Apex Senior Public Engagement Manager Anna Richey said in a recent promotional video. An Apex spokesperson declined to comment for this story.

One of the Apex green hydrogen production sites, called Big Trail, is located near Eldorado, Texas, but straddles four counties – Menard, Kimball, Sutton, and Schleicher – according to an Apex public affairs campaign.

The Big Trail project entails 3.3 GW of renewables, while another project, called Desert Trail, is sized at 1.5 GW, “with an additional 1,000 MW+ of renewable energy likely,” in Irion, Crockett, and Schleicher counties, according to the project website.

In announcing the green hydrogen partnerships in 2022, Apex, Ares, and EPIC noted that the project would “produce green hydrogen and other derivative green fuels in volumes not yet seen in the United States.” The more precise scope of the renewables for the hub has not been previously reported.

In addition to the West Texas hub, Apex is developing more renewables projects in the Texas Panhandle to power further green hydrogen production there, sources said.

World scale

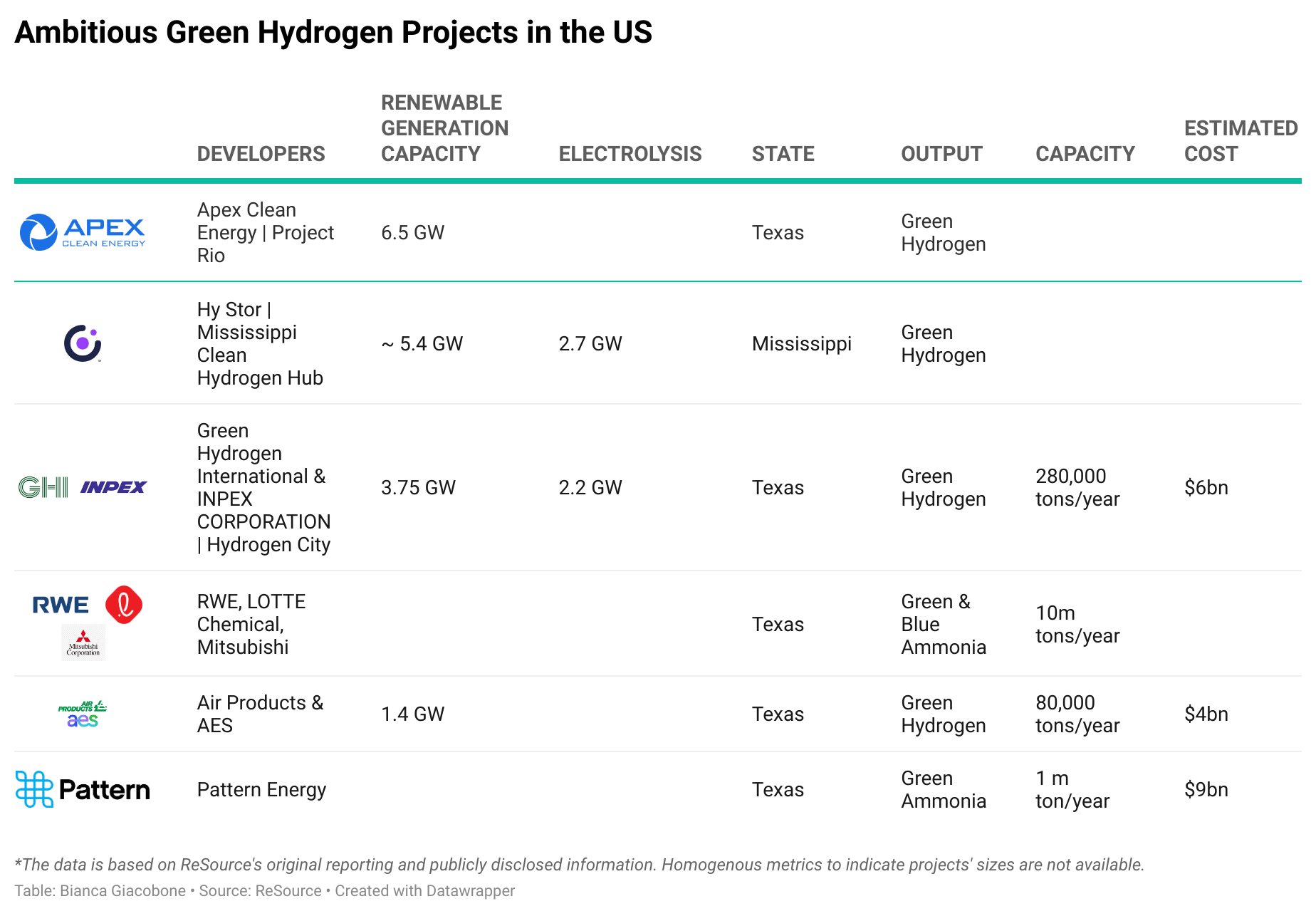

The project’s ambitious purview would put Apex and its partners at the forefront of green hydrogen development in North America. A similarly grandiose project, advanced by Hy Stor in Mississippi, would bring on around 2.7 GW of electrolyzers in the first phase, reportedly powered by twice that capacity through a mix of onshore wind, solar and geothermal energy.

Hydrogen City, a project from Green Hydrogen International and INPEX CORPORATION, is aiming to bring on 3.75 GW of behind-the-meter renewable energy for phase 1 of the project, which is in Duval County, immediately west of Corpus. At an estimated cost of $6bn, it would power 2.2 GW of electrolysis and produce 280,000 tons per year of green hydrogen, with the project size scaling up to 60 GW depending on demand.

Germany’s RWE, meanwhile, in partnership with Korea’s LOTTE Chemical and Japan’s Mitsubishi Corporation, is pursuing an integrated green and blue ammonia facility, also in Corpus Christi, that would ultimately produce 10 million tons of clean ammonia per year.

Pattern Energy is pursuing a $9bn green ammonia project with a production capacity estimated at 1 million tons of green ammonia per year – again, in Corpus Christi, ReSource has reported.

And elsewhere in Texas, Air Products and AES are developing a green hydrogen production facility in North Texas that would consist of a combined 1.4 GW of wind and solar generation, producing 200 metric tons per day of green hydrogen. The estimated cost of that project is $4bn.

Still, the technological readiness of electrolyzers for green hydrogen production at scale has been called into question by some in the industry. Sanjiv Lamba, the CEO of global chemical company Linde, recently re-emphasized his view that green hydrogen still has a roughly five to seven year runway to reach maturity for large-scale projects, in part because electrolyzer complexes are still unproven at gigawatt scale.

Apex would seek to bring its green hydrogen projects online later this decade, potentially in line with the technology development timeline referenced by Lamba.

Pipeline capacity

Apex, which is majority owned by Ares Management through its Infrastructure and Power strategy, plans to utilize a new dedicated hydrogen pipeline to be built by EPIC Midstream, another Ares portfolio company.

The pipeline aspect of the green hydrogen hub could boost its cost competitiveness against other developments in the region that will depend on trucking, as gaseous hydrogen shipped via pipeline has been shown to be a more cost-effective method of transport, especially in large volumes and over longer timelines. And experts have said it would make sense to use EPIC’s existing pipeline right of way, on which it can build without having to acquire new land rights or clear trees.

The Corpus Christi area has approximately 110 miles of existing hydrogen pipelines, while Texas’s larger hydrogen pipeline network is concentrated further east, from Freeport to Houston to Port Arthur. Thus this new pipeline proposal would open up a swath of West Texas to hydrogen transported from renewable energy facilities where, in theory, it can be made cheaply – by Apex and, potentially, by others.

“We are evaluating overbuilding the capacity of the pipeline to support others injecting,” Apex Policy Manager Laura Merten recently told Canary Media. “The goal is to support and help develop this whole hydrogen economy.”

Pattern Energy has previously discussed developing a green hydrogen project in West Texas that would tie in to a hydrogen pipeline for transport to the Gulf Coast.

EPIC has not yet filed a new construction permit for the hydrogen pipeline, according to the Texas Railroad Commission. And no other hydrogen pipelines are currently under construction in the state. Representatives of Ares and EPIC did not respond to requests for comment.

Water sources

Access to water rights can be a thorny issue in West Texas, and Apex has so far found solutions that have avoided backlash from local communities.

Apex previously burnished its green hydrogen chops by developing a 345 MW wind farm under a PPA with Plug Power for a facility in Young County, Texas. The wind farm was subsequently sold to NextEra and commissioned last year, according to local news reports and Apex’s website. The electrolyzer portion of that project is still under construction, Plug Power investor materials show.

For the Young County project, Apex helped to procure water sources for the electrolysis, ultimately working with the city of Graham to help fund and build a wastewater treatment plant, with a third of the water going to the hydrogen production facility and the remaining water used by the city for irrigation.

For Big Trail, Apex has told local officials it plans to use produced water from oil and gas drilling – dodging a potential conflict with landowners over the use of groundwater.

Another company with plans to split water via electrolysis for an e-methanol plant, ETFuels, ran into concerned local landowners at a recent meeting of the Plateau Underground Water Conservation & Supply District board of directors, which oversees water rights in the area. Instead of using groundwater, ETFuels was told by a landowner to look for alternate sources of water, “much like Apex Clean Energy proposes to do,” according to a local newspaper report.

“As we look ahead to this massive project, multiple times the scale of the previous project, we are looking for other opportunities to partner with local stakeholders and really benefit the communities we work in, and see [water development] as a huge opportunity for us,” Apex’s Merten said on a recent webinar.