Bair Energy (BE), the program management and construction management firm for the Clean Energy Holdings (CEH) Clear Fork Green Hydrogen Project in Sylvester, Texas, announced that Worley, a global leader providing engineering, procurement and construction (EPC) services, has joined the team to develop the Front-End Engineering and Design (FEED) package.

Worley will bring green hydrogen production expertise to this project, also known as renewable hydrogen. Design integration of the hydrogen, renewable energy, and other components of the project will be their focus. Worley, along with the Green Hydrogen and Technology Alliance, will bring expertise enabling practical hydrogen output from the available renewable power.

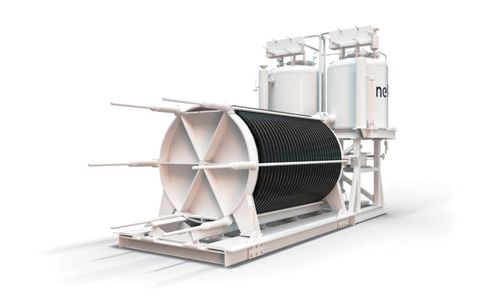

The Clear Fork Project consists of a 250 MW solar to liquified hydrogen plant, that will produce up to 33,000 kg of green hydrogen daily. Daily capacity will be designed to ultimately increase to 132,000kg by 2028. The project, located near Sylvester, Texas, is one of the largest such projects in the U.S. to date and is a major milestone in the adoption of green hydrogen as a key part in the global journey towards an affordable, sustainable and carbon-neutral energy mix, the release says.

“We are proud to advance this project and the adoption of renewable hydrogen on the U.S. Gulf Coast, which has an important role to play in the energy transition,” said Amanda Knost, Worley president of the U.S. Gulf Coast region, “Partnering with Bair to develop their hydrogen projects is consistent with Worley’s purpose of delivering a more sustainable world.”

Candice McGuire, BE’s Chair and General Manager for the Clear Fork Project, said: “Worley is a world class, industry-leading EPC firm with extensive expertise within the energy sector. Worley’s proven project delivery model, as well as the synergies between Worley and each of our Alliance Partners are critical for the continued success of the Clear Fork Project, led by Bair Energy. We are excited to have Worley join the team and look forward to a long-lasting relationship.”