Calumet Specialty Products subsidiary Montana Renewables recently acquired the second reactor needed to expand the scope of its sustainable aviation fuel production, according to a company update.

While the company has not made a final installation decision, great interest from the existing Lazard process warranted the opportunistic reactor purchase, the release says.

“Our strategy to retain a downsized crude oil refinery while carving out Montana Renewables meant a higher degree of difficulty compared to simply converting a closed refinery,” said Bruce Fleming, EVP Montana Renewables and Corporate Development. “Delivering an aggressive timeline, navigating two winter construction seasons, minimizing 2022 downtime for turnaround and carveout, building safely on an operating site, and moving quickly through commissioning all demonstrate the high capabilities of the Great Falls workforce. While not without setbacks, we are proud of the journey. Going forward, the full economic contribution of the specialty asphalt refinery will follow normal seasonal patterns, and Montana Renewables will reach steady state earnings after the first quarter commissioning sequence is complete.”

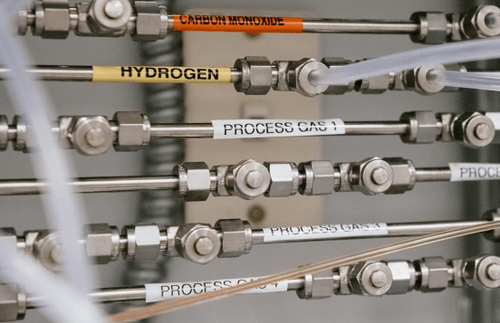

Montana Renewables commissioned its modified hydrocracker in renewable diesel service on November 5, then retrofitted additional winterization capability during the month of November. It generated a full month of on-spec Renewable Diesel production in December and commenced rail shipments late in the month after establishing product inventories. Catalyst performance has been consistent and met the expected performance envelope provided by Haldor Topsoe. The current 6,000 bpd capacity will increase to 12,000 bpd with the sequential commissioning of renewable hydrogen, SAF, and feedstock pre-treater which are expected online in that order in 1Q2023.

Preliminary engineering and procurement is beginning for the expected 2024 expansion including the option to maximize SAF yield to 85%, according to the update.