Tourmaline Oil Corp. and Clean Energy Fuels Corp. announced today a CAD 70m Joint Development Agreement to build and operate a network of compressed natural gas (CNG) stations along key highway corridors across Western Canada.

Through this 50-50 shared investment, Tourmaline and Clean Energy expect to construct and commission up to 20 CNG stations over the next five years, which will allow heavy-duty trucks and other commercial transportation fleets that operate in the area to transition to the use of CNG, a lower carbon alternative to gasoline and diesel.

Clean Energy will operate the stations. One of North America’s largest logistics companies, Mullen Group Ltd. has indicated its support for the initiative as an early adopter and expects to use the network of stations to fuel its growing fleet of CNG-powered trucks.

“Tourmaline is Canada’s largest natural gas producer, and innovation is at the heart of everything we do. So this partnership with Clean Energy is a natural fit,” said Michael Rose, chairman, president and CEO, Tourmaline. “Across our operations, we have achieved significant emission reductions and cost savings by displacing higher-emitting fuels with natural gas. Thanks to this exciting initiative, we’re able to help the transportation industry do the same.”

This initiative will develop critical infrastructure needed to support the adoption of lower-carbon natural gas fuels that are commercially available today. The use of this domestic, abundantly produced and easily distributed resource is expected to result in significant carbon dioxide (CO2) emission reductions and cost savings for the transportation industry in Canada. Currently, fueling vehicles with CNG results in up to 50% cost savings when compared to retail diesel prices, on an energy equivalent basis. These CNG stations also pave the way for renewable natural gas (RNG) availability in the future, as the same fueling-station infrastructure that dispenses CNG can be used to dispense RNG.

“Clean Energy currently operates the most extensive network of natural gas fueling stations and is the largest distributor of RNG in North America. We continue to invest in upstream production of RNG and the fueling infrastructure needed to provide the trucking industry a cleaner alternative of operating,” said Andrew Littlefair, president and CEO, Clean Energy. “This new partnership with Tourmaline will provide Canada’s trucking industry with an economical, convenient, and sustainable pathway to net zero and will contribute to Canada’s overarching climate change goal.

“As one of North America’s largest logistics providers, the Mullen Group is committed to being a leader in sustainability. We are excited to support this initiative. We have already made a significant investment in CNG trucks and are extremely confident that this technology will play a huge role in the decarbonization of our industry,” said Murray Mullen, chair, SEO and president, Mullen Group.

Based on the anticipated commissioning of up to 20 stations over the next five years, approximately 3,000 natural gas-powered trucks could be fueled using CNG every day, resulting in a reduction of approximately 72,800 tonnes of CO2 equivalent usage per year. This is equivalent to removing 15,690 passenger vehicles from the road. As future demand increases, the capacity of these stations can be expanded, and new stations added, which would result in greater environmental performance improvement.

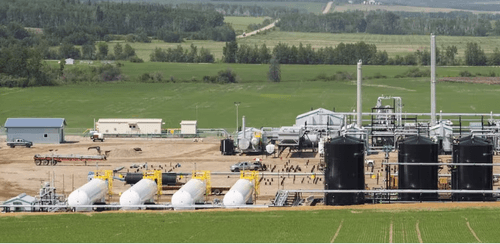

The first station expected to be jointly owned under the agreement, located north of Edmonton, is operational and well-positioned for heavy-haul transport routes with close proximity to key customers and stakeholders. The next stations which Tourmaline and Clean Energy expect to commission in the first half of 2024 are anticipated to be located within the municipalities of Calgary and Grande Prairie in Alberta and Kamloops, B.C.