Chevron U.S.A. Inc., through its Chevron New Energies division, announced it has closed a transaction with Haddington Ventures to acquire 100% of Magnum Development, LLC (Magnum Development) and thus a majority interest in ACES Delta, LLC (ACES Delta), which is a joint venture between Mitsubishi Power Americas, Inc. (Mitsubishi Power) and Magnum Development, according to a news release.

ACES Delta is developing the Advanced Clean Energy Storage project in Delta, Utah.

Chevron last year backed out of its plans to acquire a stake in the joint venture.

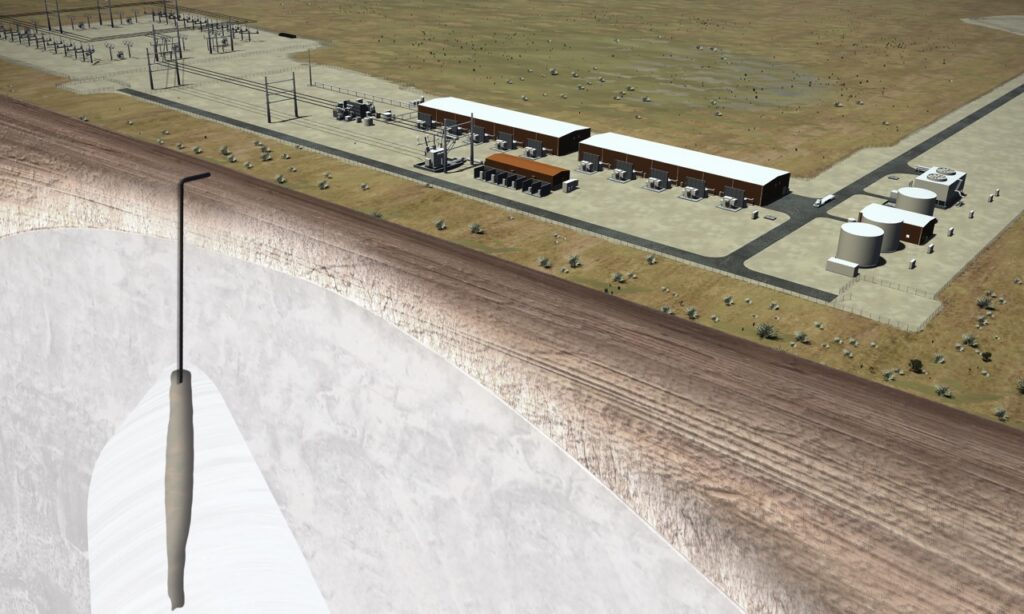

The Advanced Clean Energy Storage project plans to use electrolysis to convert renewable energy into hydrogen and will utilize solution-mined salt caverns for seasonal, dispatchable storage of the energy.

The first project, designed to convert and store up to 100 metric tons per day of hydrogen, is under construction and is expected to enter commercial-scale operations in mid-2025 to support the Intermountain Power Project’s “IPP Renewed” initiative. Several other opportunities for the project to produce and supply hydrogen to customers in the utility, transportation and industrial sectors in the western region of the United States are in development.

“As we continue to pursue lower carbon energy solutions, we are excited to move forward with the Advanced Clean Energy Storage hydrogen project, through our acquisition of Magnum Development and partnership with Mitsubishi Power, to build on Chevron’s 75-year history in Utah,” said Austin Knight, vice president, Hydrogen, Chevron New Energies. “We seek to leverage the unique strengths of each partner to develop a large-scale, hydrogen platform that provides affordable, reliable, ever-cleaner energy and helps our customers achieve their lower carbon goals.”

As part of broader efforts to pursue lower carbon energy solutions, Chevron New Energies is working to enhance demand for lower carbon intensity hydrogen – and the technologies that support cost-effective supply – as a commercially viable alternative in the transportation, power, and industrial sectors where greenhouse gas emissions are hard to abate.

“Reaching this milestone in the development of our hydrogen project will not only have significant benefits to the western U.S. population, but it will also serve as a blueprint for future hydrogen opportunities,” said Michael Ducker, senior vice president of Hydrogen Infrastructure for Mitsubishi Power. “With Chevron New Energies’ involvement, we expect to expand hydrogen supply more quickly. Together, we are investing in the future of hydrogen, helping to create a viable, cost-competitive market for emerging lower carbon solutions.”

“People look to Utah as the place where we work together to find solutions addressing today’s biggest challenges,” said Utah Gov. Spencer Cox. “This announcement demonstrates that our state has fostered a landscape where clean energy innovation is possible.”

“I look forward to this partnership with Chevron in the ACES Delta mission. Chevron will add tremendous strategic value as we develop a hydrogen production and storage facility,” said Craig Broussard, president, CEO and board chairman of Magnum Development.

“Haddington Ventures is very excited to see Chevron coming on board as the new majority owner at ACES Delta,” said John Strom, managing director, Haddington Ventures. “Having been the primary financial sponsor behind this key energy hub since 2008, we believe this transaction will accelerate lower carbon intensity solutions that reduce emissions in the western United States. Haddington Ventures will remain committed to the success of ACES Delta through its role in management of the investment vehicle that is providing construction equity to the current project.”

Citigroup Global Markets, Inc. served as financial advisor to Chevron. Jefferies LLC served as financial advisor to Haddington.