A consortium led by German energy firm Juniper has taken the final investment decision on a 30 MW green hydrogen facility, the Bad Lauchstädt Energy Park.

The consortium, made up of Terrawatt, Uniper, VNG Gasspeicher, ONTRAS, DBI and VNG, said this week they are moving ahead with the project in spite of cost increases from EUR 140m at the start of the project to EUR 210m currently.

Two additional companies will join the project following FID. The construction and operation of the electrolyser will from now on be shared between Uniper and VNG Handel & Vertrieb, and additionally, the consortium partners were able to attract TotalEnergies Refinery Central Germany as the first anchor customer for green hydrogen, according to a news release.

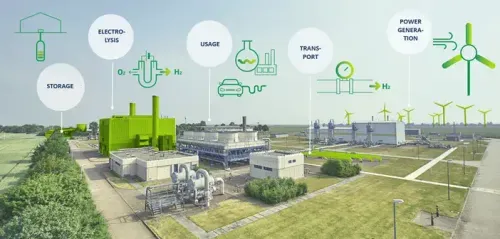

According to the release, work on the 30 MW electrolyser built by Sunfire, which will take about two years, and on the gas transport pipeline that is to be converted, including the construction of a new airlock for introducing pigs to the network, will start shortly.

In 2024, the TotalEnergies refinery in Leuna will then be hooked up by means of construction of the first network connection to the future ONTRAS hydrogen network.

Trial operation will start in early 2025, and from the third quarter of 2025 the pipeline is scheduled to transport green hydrogen from the Bad Lauchstädt Energy Park for use in the TotalEnergies Refinery Central Germany.