Green ammonia used as a bunker fuel from Corpus Christi would be competitive on a global scale largely thanks to the Inflation Reduction Act, according to a study from RMI, Global Maritime Forum, and the Zero-Emission Shipping Mission.

The report “Oceans of Opportunity: Supplying Green Methanol and Ammonia at Ports” provides an analysis of the strategic developments necessary for ports to adapt and become leaders in the supply of green methanol and ammonia.

Ports are being categorized into archetypes such as Importing Incumbents, Producing Incumbents, Future Exporters, and Bespoke Players. This classification helps in identifying the strategic actions these ports can take to align themselves with the emerging demand for green fuels.

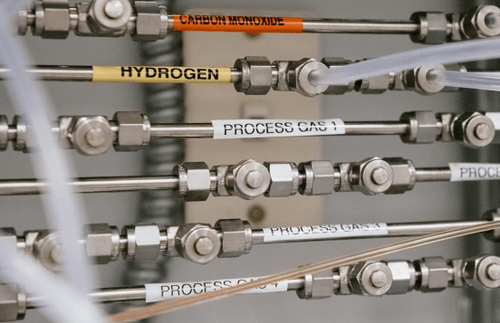

Significant infrastructure investments are required for ports to facilitate the production, storage, and bunkering of green fuels like methanol and ammonia. This includes adapting existing facilities and building new ones tailored to handle these less conventional fuels.

According to the report, Singapore is classified as an importing incumbent, while the Port of Algeciras is a producing incumbent. The Port of Corpus Christi is identified as a future exporter; the Ports of Seattle and Tacoma are bespoke players; and the Port of Rotterdam is a bespoke player.

In the case of Corpus Christi, the region possesses excellent renewable energy resources, particularly wind and solar, which are critical for the cost-effective production of green hydrogen—an essential precursor for green ammonia.

The port area already has a strong industrial base with existing infrastructure suitable for large-scale energy projects, including pipelines and storage facilities. This existing infrastructure can be repurposed or adapted at lower costs compared to building new facilities from scratch.

The report also highlights the impact of the Inflation Reduction Act, which provides substantial tax credits and incentives for renewable energy projects. These incentives can significantly reduce the production costs of green hydrogen and, by extension, green ammonia.

Crucially, the report highlights the possibility to reduce the cost of green ammonia an additional 30% by “doubling up” and facilitating both ammonia exports and ammonia as a bunker fuel.

“Any ammonia storage and jetties will be able to ‘double up,’ facilitating both ammonia exports and bunkering,” the report reads. “Not only will this make investments in this infrastructure more feasible, but it also has the potential to significantly reduce the last-mile bunkering premium.”

The report continues, “If the full pipeline of ammonia export projects around the port is realized, this would reduce the delivered cost of ammonia bunkers by ~30% compared to if the infrastructure were developed solely for bunkering.”

The report shows that the delivered cost of green ammonia to the Port of Corpus Christi could drop as low as $850 per ton under the higher throughput scenario involving both exports and bunkering.