Distressed sustainable aviation fuel developer Velocys has agreed to be taken over by a consortium of investors in a cash deal worth £4.1m.

Based in the UK, and with projects there and in the US, Velocys said last month that, unless it was able to find meaningful sources of funding or strategic options, it was unlikely that the company would be able to continue as a going concern beyond the end of December 2023. This date has now been extended into early-January 2024 as a result of cost control and cash management initiatives, the company said in a December 5 market update.

A fund advised by Lightrock, a fund advised by Carbon Direct Capital along with GenZero and Kibo Investments formed the investor consortium, called Madison Bidco, to take over Velocys. As part of the deal, the investors will inject $40m of growth equity into the company, “which is expected to ensure that Velocys and its management have the capital resources needed to deliver against Velocys’ medium-term strategic plans,” the release notes.

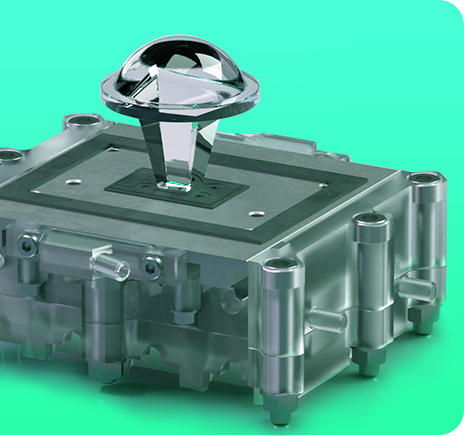

Velocys in October announced a new technology facility in Plain City, Ohio, that will house the reactor core assembly and catalysis operations related to its production process for sustainable aviation fuel.

The company is currently developing two proposed SAF projects, including the Bayou Fuels project in Natchez, Mississippi, which aims to produce 36 million gallons per year of SAF from woody biomass feedstock.

The Altalto project in Immingham, UK would produce 20 million gallons per year of SAF from municipal and commercial solid waste feedstock.