The Biden-Harris Administration, through the U.S. Department of Energy (DOE), today announced up to $47m in funding to accelerate the research, development, and demonstration (RD&D) of affordable clean hydrogen technologies.

Projects funded under this opportunity will reduce costs, enhance hydrogen infrastructure, and improve the performance of hydrogen fuel cells—advancing the Department’s Hydrogen Shot goal of reducing the cost of clean hydrogen to $1 per kilogram within a decade, according to a release.

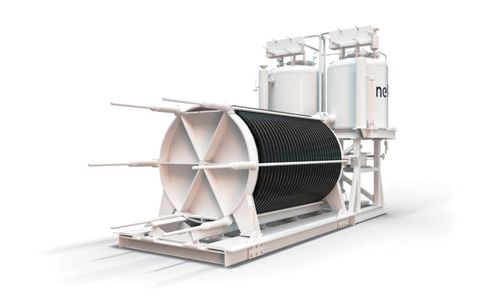

This funding opportunity, which is administered by DOE’s Hydrogen and Fuel Cell Technologies Office (HFTO), focuses on RD&D of key hydrogen delivery and storage technologies as well as affordable and durable fuel cell technologies. Fuel cell RD&D projects will focus particularly on applications for heavy-duty trucks, to reduce carbon dioxide emissions and eliminate tailpipe emissions that are harmful to local air quality. These efforts will work in concert with hydrogen-related activities funded by President Biden’s Bipartisan Infrastructure Law, including the Regional Clean Hydrogen Hubs and an upcoming funding opportunity for RD&D to advance electrolysis technologies and improve the manufacturing and recycling of critical components and materials.

For all topic areas, DOE envisions awarding financial assistance awards in the form of cooperative agreements. The estimated period of performance for each award will be approximately two to four years. DOE encourages applicant teams that include stakeholders within academia, industry, and national laboratories across multiple technical disciplines. Teams are also encouraged to include representation from diverse entities such as minority-serving institutions, labor unions, community colleges, and other entities connected through Opportunity Zones.

The application process will include two phases: a Concept Paper phase and a Full Application phase. Concept papers are due on February 24, 2023, and full applications are due on April 28, 2023.