The following is a summary of a new report from the Clean Air Task Force (CATF) that analyzes the costs of different methods for long-distance import of low-carbon ‘blue’ hydrogen to Europe, finding that the potential import of uncracked ammonia is among the cheapest ways to bring hydrogen to the continent.

The report, which is based on studies conducted by Houston-based engineering consultant KBR, considers pipeline transport of gaseous hydrogen from Algeria and Norway and maritime (ship) transport of either liquid hydrogen, ammonia, or a liquid organic hydrogen carrier (methylcyclohexane) from Norway, the Arabian Gulf region, and North and South America to Europe’s largest seaport, the Port of Rotterdam in the Netherlands.

Of the pathways for delivering hydrogen considered in the analysis, three options consistently ranked as most cost-effective across all supply chain volumes: gaseous hydrogen by pipeline from Norway and Algeria and ammonia via maritime shipping from the Arabian Gulf. Estimated cost per kilogram (or MWh) of delivered hydrogen is lower for these options than for all other geographies and transport options, including ship transport of liquid organic hydrogen carriers (such as methylcyclohexane) and liquid hydrogen.

For pipeline transport, Norway is the lowest-cost exporter at the smallest supply volume considered (250,000 tonnes hydrogen per year). At higher pipeline transport volumes, Algeria, because of its lower natural gas prices, is the lowest cost exporter.

Ammonia emerges

Among the maritime transport options considered, ammonia emerges as the lowest-cost carrier, regardless of export location, according to the study. The Arabian Gulf is the lowest-cost exporter, largely due to a combination of low natural gas prices, geographic proximity to Rotterdam, and competitive construction costs.

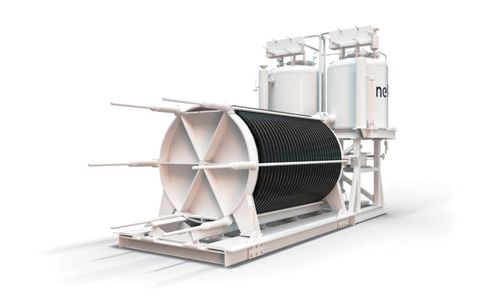

Ammonia is already one of the most widely used chemicals in the world—as a result, production methods are well-developed, storage and transport requirements are well understood, and extensive infrastructure for producing and distributing ammonia, including ships and terminals, already exists. Ammonia is also much less demanding than LH2 in terms of the temperature and pressure conditions required to keep it liquid — this means that it can be stored in common ‘Type C’ pressurized tanks and requires no specialized handling or equipment.

KBR assumed use of the Haber-Bosch process, which already accounts for most ammonia production in the world, to convert gaseous hydrogen and air to ammonia. This part of the value chain requires heat and electricity inputs, but the technologies and processes involved are mature.

By contrast the technologies needed to efficiently dehydrogenate (or ‘crack’) ammonia to liberate hydrogen once it reaches the import destination are still in relatively early stages of development. Present methods for cracking ammonia require significant energy inputs, the report notes.

“Import pathways that rely on the long-range transport of liquefied pure hydrogen or on a liquid organic hydrogen carrier that requires dehydrogenation to liberate pure hydrogen at the point of import should be avoided as they do not make sense from an energy, emissions, or economic standpoint,” the report says. “Capital requirements and levelized costs for these pathways are far higher (in some cases close to double) the costs for importing hydrogen in the form of uncracked ammonia.”

Further study

The CATF therefore recommends further study to identify what part of Europe’s expected hydrogen demand could be met by uncracked ammonia and additionally spur development of related technologies and infrastructure in applications where no more efficient or cost-effective decarbonization option exists.

Estimated costs for ammonia imports from locations in North and South America are on the order of 10%–15% higher than estimated costs for ammonia imports from the Arabian Gulf (the modeled cost differential ranges from $0.20 to $0.40 per kilogram of delivered hydrogen, or $6–$12 per MWh of delivered hydrogen, depending on overall import volume).

Across all supply chain volumes, importing hydrogen in the form of ammonia from the U.S. Gulf Coast consistently ranked as the fourth most cost-effective option in the study. The U.S. position could improve further as a result of widening natural gas price differentials between U.S. and European hubs and recently passed policy incentives in the United States, including a new federal tax credit for clean hydrogen production in the Inflation Reduction Act of 2022.

Importantly, the analysis was conducted before the passage of the Inflation Reduction Act, and therefore does not take into account the provisions for clean hydrogen production and carbon capture. The report does note, however, that the recently adopted U.S. tax policies, by reducing the cost of producing clean hydrogen in the United States, could also make the countty a more appealing supplier to future global markets for low-emissions hydrogen and ammonia.