Electric Hydrogen has completed an oversubscribed $38m Series C financing.

The new capital will accelerate the company’s manufacturing and deployment plans to meet strong customer demand for its power-dense green hydrogen systems, according to a news release.

The funding round was led by Fortescue, Fifth Wall and Energy Impact Partners and included new investors bp Ventures, Oman Investment Authority, Temasek, Microsoft’s Climate Innovation Fund, the United Airlines Sustainable Flight Fund, New Legacy, Kajima Ventures and Fatima Holdings USA. Existing strategic investors Amazon’s Climate Pledge Fund, Equinor Ventures, Mitsubishi Heavy Industries, and Rio Tinto continued their participation, as did previous financial investors Breakthrough Energy Ventures, Capricorn Partners, Prelude Ventures, and S2G Ventures.

EH2 has raised over $600 million since its founding in 2020. In a separate release, Fortescue said it had signed a framework procurement agreement to supply 1 GW of EH2’s electrolyzer systems to Fortescue’s green hydrogen projects in the US and globally.

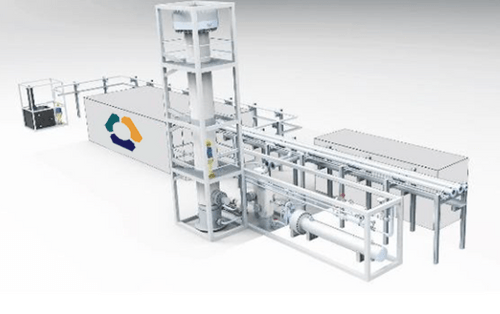

EH2’s electrolyzer systems produce green hydrogen from renewable electricity and water. Green hydrogen is needed for decarbonizing vital industrial processes such as fertilizer production, steelmaking, base chemicals and many others. Until now, switching from fossil-based sources to renewable green hydrogen has been too costly to be implemented at scale. EH2 is manufacturing and plans to deliver and commission 100 MW electrolyzer systems, each capable of producing nearly 50 tons of green hydrogen per day at transformational low cost to help its customers meet their decarbonization goals.

“We’re here to replace natural gas and coal with renewable green hydrogen. To address the global climate challenge, we need new technologies that help critical industries reduce their emissions. Electric Hydrogen’s 100MW electrolyzer systems do that”, said Raffi Garabedian, Chief Executive Officer and Co-founder of EH2. “Today’s hydrogen comes from natural gas and coal and accounts for around 2.5% of global carbon emissions. There has not been a viable solution to this problem because renewable green hydrogen has been too expensive to produce at scale. The Electric Hydrogen team is changing that and the opportunities for decarbonization go far beyond today’s applications”.

The company is currently installing manufacturing equipment in its 1.2 GW factory in Devens, Massachusetts. The factory will begin producing commercial electrolyzer systems in early 2024, with deliveries later in the year including the first customer-sited electrolyzer plant to be installed in Texas for New Fortress Energy. Electric Hydrogen has more than 5 gigawatts (GW) of its electrolysis systems reserved by customers and anticipates strong ongoing demand.

Fortescue, a global metals and green energy company, is both a lead investor and potential customer, having also signed a procurement agreement with EH2. “Fortescue is committed and focused on supporting the creation of green technology to help heavy industry decarbonize and producing green hydrogen at scale globally is integral to that”, said Mark Hutchinson, Fortescue Energy CEO. “Electric Hydrogen, just like Fortescue, is working at the speed and scale necessary to help deliver green-hydrogen projects around the world”.

“bp Ventures invests in game-changing and innovative technology across bp’s transition growth engines and in the energy the world needs today, said Gareth Burns, Vice President of bp Ventures. “Electric Hydrogen’s 100MW green hydrogen systems use advanced technology that could significantly reduce production costs. Investing in technologies that could help to advance green hydrogen production is crucial as we progress our global hydrogen portfolio and work towards our net zero ambition.”

“Scalable and cost competitive access to green hydrogen is key to the production of Sustainable Aviation Fuel – for United and others that seek a transition to clean energy. Electric Hydrogen’s novel electrolyzers have the potential to greatly reduce the capital cost of hydrogen production and their electrolyzers can be powered by a variety of renewable power sources,” said United Airlines Ventures President, Michael Leskinen. “United’s need for sustainable aviation will require scaling the supply of green hydrogen, and we believe Electric Hydrogen’s technology could be game changing.”