GASCADE and Fluxys have applied to the European Commission for Project of Common Interest (PCI) status for the AquaDuctus project, marking a major step forward in their plans for an offshore pipeline for green hydrogen in the North Sea, according to a news release.

The move by the two infrastructure operators highlights the project’s importance for the hydrogen ramp-up.

“The offshore pipeline, which will be over 400 km long when completed, will become a linchpin of Germany’s and Europe’s future offshore hydrogen infrastructure,” said GASCADE Managing Director Christoph von dem Bussche, emphasizing the project’s European, interconnecting character.

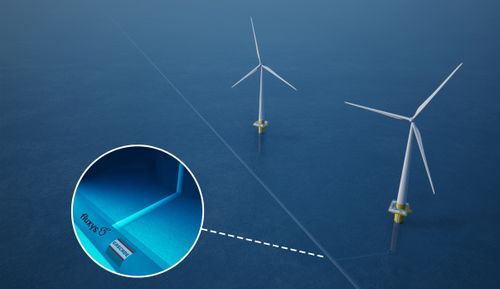

That is because the pipeline is designed as a “backbone,” able to collect hydrogen from multiple production sites while also offering the potential to link up with other international hydrogen flows through the North Sea. Hydrogen will be taken to the German coast via the offshore pipeline and fed into the onshore hydrogen network there. In this way, AquaDuctus will provide large-scale offshore hydrogen infrastructure in the German North Sea for hydrogen to be imported into Germany.

GASCADE and Fluxys have ambitious plans for this project. The first step will see the SEN-1 hydrogen wind farm connected to AquaDuctus, with flows to start in 2030. In subsequent years, wind farms further offshore in Germany’s exclusive economic zone may be linked up as well as hydrogen infrastructure operated by other North Sea countries. By 2035, the offshore pipeline is to develop into a main hydrogen corridor carrying up to one million tonnes of hydrogen a year into Germany. Based on the gas and hydrogen package currently being negotiated at European level, the two long-standing transmission system operators plan the AquaDuctus offshore pipeline as a regulated open access infrastructure available to all future operators of hydrogen wind farms, thereby strengthening security of supply in the future.

“We firmly believe that the AquaDuctus offshore pipeline will be a key element of Europe’s future energy supply picture and a major advance in the drive towards climate neutrality,” says Fluxys Managing Director and CEO Pascal De Buck. The offshore pipeline will make a substantial contribution to security of supply by diversifying Europe’s hydrogen supply sources. “Our specific plans for AquaDuctus will allow Germany’s federal government to put in place concrete actions following up the efforts it has made on hydrogen with European partners such as for example Norway or within the framework of the Esbjerg Declaration,” said von dem Bussche, underscoring the feasibility of the project.

Studies identify up to 100 GW of hydrogen production potential in the German and European North Sea and view an integrated European offshore pipeline network as the ideal transport solution. “With our AquaDuctus offshore pipeline, we want to jointly enable this potential to be leveraged,” explain the two managing directors.

A comprehensive feasibility study for the project has been successfully completed. The study examined and confirmed the technical and planning feasibility of all phases of the project. Commercial aspects, marketing potential, pricing and regulatory design options were also analyzed.