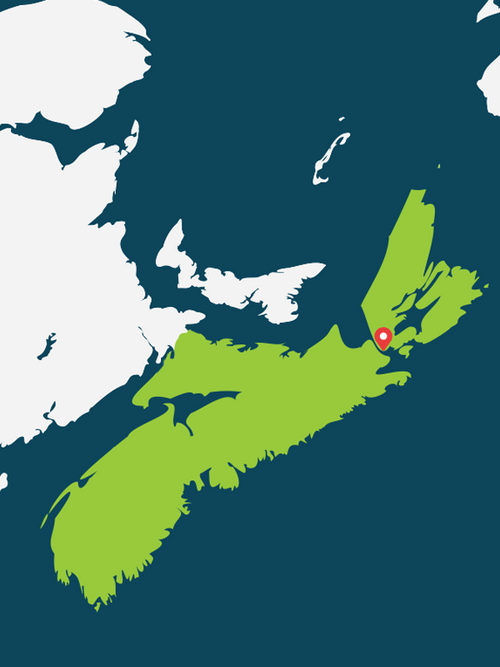

EverWind Fuels Company has selected Black & Veatch to provide front-end engineering design (FEED) services for its green hydrogen and ammonia production and storage facility in Point Tupper, Nova Scotia, with initial commercial operations planned for 2025, according to a news release.

EverWind is a private developer of green hydrogen and ammonia production and storage sites, and global engineering and construction company Black & Veatch is a green energy solutions leader.

In its first phase, the facility will produce green hydrogen and green ammonia through electrolysis using certified green power from the Nova Scotia Power transmission system; onshore wind generation will power production in a second phase. In future phases, EverWind will use offshore wind power to produce hydrogen through electrolysis, unlocking Nova Scotia’s offshore wind capabilities. The first two phases will produce a combined 1 million tonnes per annum of green ammonia.

“EverWind is committed to delivering on our commitment to develop Nova Scotia into a global green energy hub,” said Trent Vichie, EverWind’s CEO. “Green hydrogen and ammonia will play key roles in the fight against climate change and the desire for improved energy security in Europe, and Black & Veatch lends incredible expertise and experience in green hydrogen, ammonia and project development. By working together with Black & Veatch and our partners in government, industry and Indigenous communities, we are sending a clear message to the world that we are in this fight together.”

“This ambitious project exemplifies how green hydrogen and ammonia are continuing their trajectories in tomorrow’s reimagined energy ecosystem as a rapidly decarbonizing world transitions to cleaner energy,” added Laszlo von Lazar, president of Black & Veatch’s energy and process industries business. “As a global leader in designing and building green energy projects around the globe, Black & Veatch remains committed to delivering projects that pave the way to a lower-carbon future.”