Electrochaea, the US- and Europe-based biomethane developer, will go to market in 1Q24 for a new round of equity funding, with a near term need for project debt as well, two executives told ReSource.

The company, which was spun out from an incubator at The University of Chicago with offices in Denmark, has projects in Denmark, Colorado, New York and Switzerland. It is backed by Baker Hughes and, from early fundraising efforts, Munich Venture Partners, senior director Aafko Scheringa said. The former investor participated in its most recent (fourth) $40m funding round.

The average size of a project is roughly $25m, Scheringa said.

Funds from the next round will provide three years of working capital, CEO Mitch Hein added.

Electrochaea has not worked with a financial advisor to date, Hein said, adding that he may have need for one for new processes but has not engaged with anyone.

Scheringa said he is working to achieve commercialization on a pipeline of projects, with a 10 MWe bio-methanation plant in Denmark being farthest along with a mandatory start date before 2026.

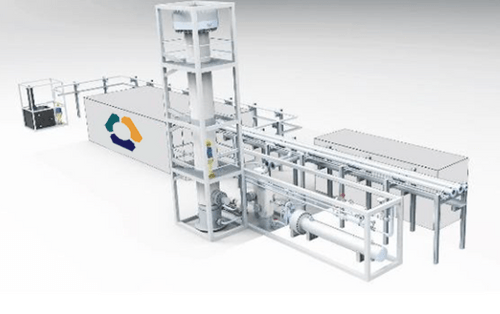

Electrochaea has a bio-methanation reactor system in partnership with SoCalGas at the US Department of Energy’s National Renewable Energy Laboratory (NREL) Energy System Integration Facility in Golden, Colorado, though Hein said a project in New York is as advanced in its development.

Bio-methane can be burned in place of natural gas with no systems degradation issues, so gas offtakers are a natural fit for Electrochaea, Scheringa said. Cheap clean electricity paired with available CO2 is critical, so the company will look to places like Texas, Spain, Scandinavia, Quebec and the “corn states” of the US Midwest, for new projects.