Glenrock Energy has hired an advisor and is seeking to raise $33m in development capital for its first coal-to-blue ammonia project in Kemmerer, Wyoming.

The Wyoming-based developer is working with RBC Capital Markets on the capital raise, which includes pre-FID development capital as well as eventual construction financing for the estimated $2.5bn project, Glenrock Managing Director Matthew Coeny said in an interview.

The proposed facility, known as Kemmerer Decarbonization Works, would utilize approximately 1.8 million tons per year of Wyoming coal, either from the nearby Kemmerer coal mine or other sources, and convert it to 600,000 tons per year of blue ammonia. It would also capture 2.7 metric tons of CO2 per year.

The $33m capital raise would cover pre-FID development activities. However, any development capital raised could be matched on a one-to-one basis through a Wyoming state funding program known as the Governor’s Energy Matching Fund, meaning Glenrock’s private capital need is $16.5m, Coeny said.

The firm is engaging with financial institutions and potential strategic partners as well as high-net-worth, family-office types, particularly those with an interest in Wyoming.

Glenrock estimates there is a 500,000 metric ton per year deficit for ammonia in the 300-mile radius around the Kemmerer mine, and is targeting consumers in the area as primary offtakers, Coeny added. The proposed facility is near rail lines that would allow access to West Coast ports for potential export.

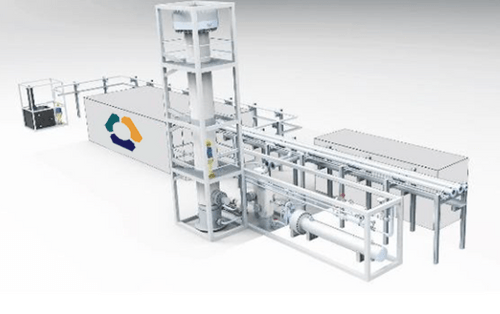

The project design utilizes four established technologies in combination: coal gasification, ammonia synthesis, onsite electricity generation, and carbon capture.

For the carbon capture and sequestration aspect of the project, Glenrock’s preferred alternative would be to pipe into the existing CO2 system in the state owned by ExxonMobil for sequestration. Alternatively, Glenrock is development its own sequestration projects in central Wyoming.

Once the pre-FEED study is launched, the project has a roughly 18 – 24 month process leading up to FID, followed by an anticipated three years of construction. That means the project could be operational as early as late 2028, Coeny said.

Coeny said that the selection of coal as a feedstock serves a number of purposes: it repurposes existing coal reserves and provides a hedge against swings in natural gas prices, such as those experienced following the Russian invasion of Ukraine.

While coal is cheaper than natural gas on a per-MMBtu basis there is an added cost to gasify it. “Our expectation based on the long-term outlook for natural gas is that Wyoming coal is competitive with natural gas production […] and not subject to price volatility,” he said.

Furthermore, he added, the project’s economics result in a production cost below the anhydrous ammonia prices published by the USDA for the U.S. Midwest. Anhydrous ammonia was quoted with an average price of $776.25 per ton in Iowa last week.