Charbone, a publicly traded green hydrogen developer based near Montreal, has retained a financial advisor and is seeking equity capital for a pipeline of smaller scale projects in Canada and the US.

The company is working with advisory firm US Capital Global to raise $5m in equity capital to support the first phase of its flagship green hydrogen project, the Sorel-Tracy plant, located about 45 minutes from Montreal, CFO Benoit Veilleux said in an interview.

The Sorel-Tracy project, which could expand to up to 10 tonnes per day of production, requires about $2m of capital in order to advance through phase 1, which would amount to a capacity of approximately 200 kg per day. The balance of the raise would support development of additional projects, including one in Michigan that will seek to provide green hydrogen for the automobile industry, Veilleux said.

Veilleux expects that the projects will eventually be back-levered through a debt raise, and that Canada’s export agencies, including Investissement Québec, will be involved in providing financing.

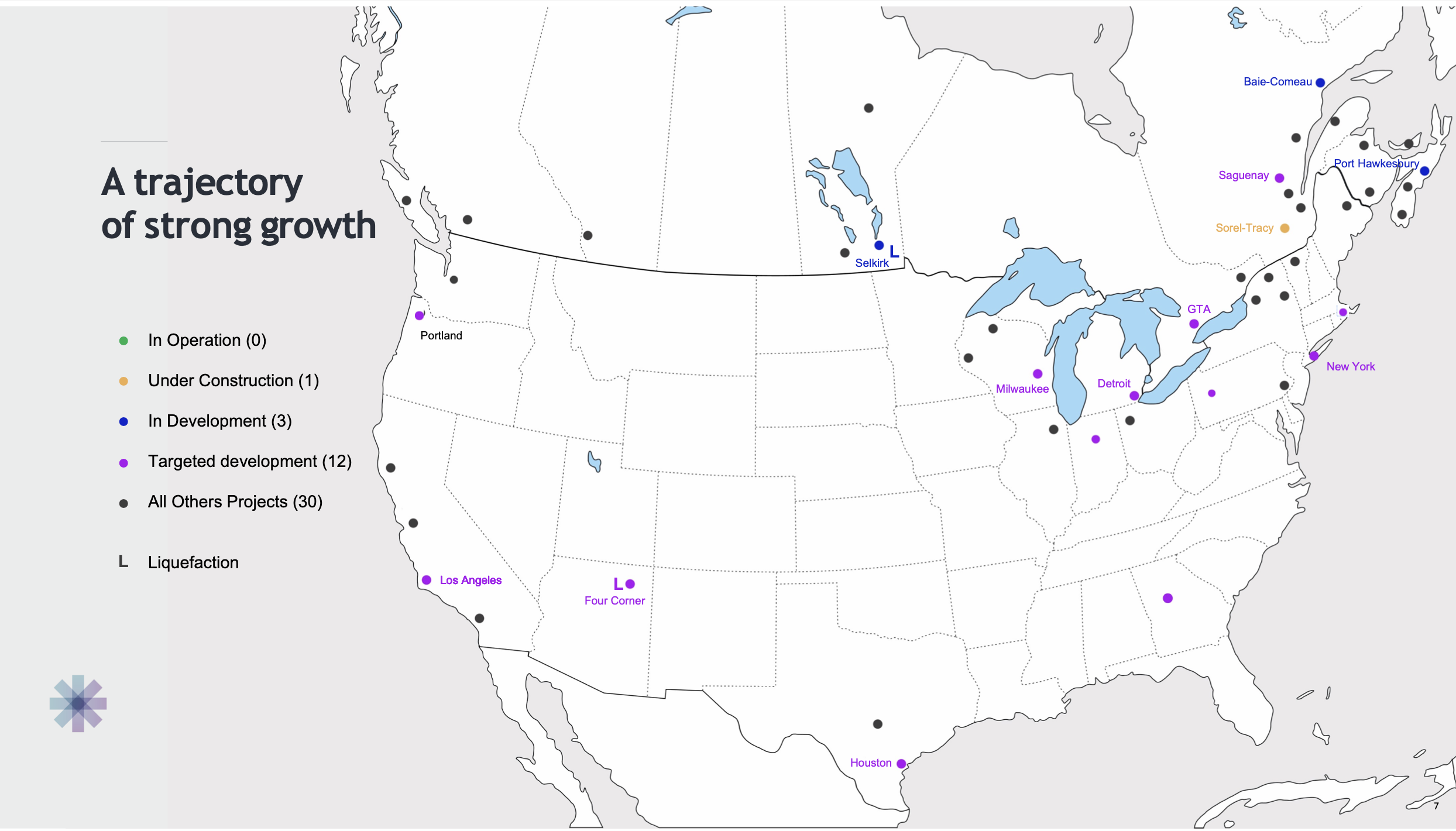

In total, Charbone plans to scale and deliver 16 green hydrogen production facilities in the US and Canada by 2030, each set up as a separate legal entity with its own strategic and financial backers. The company is also working with New York-based Maxim Group on additional project financing and equity raise aspects of its project pipeline.

Charbone believes the smaller scale of their projects give it a near-term advantage in getting projects off the ground, according to Veilleux, as they are finding offtakers interested in the product now, versus waiting several more years for larger projects to come online.

“We’re focusing on this niche and we have a window, we think of 10 to 15 years where there’s big players or big projects that will start to come into play,” he said. “But at the end of the day, it’s a massive market that is increasing every day.”

Charbone is working with renewable energy construction firm EBC Inc. to lead project delivery, and has signed offtake contracts with Superior Plus, a North American gas marketer and distributor.

While Charbone has chosen its sites to be close to industrial demand, it chose to sign offtake agreements with a distributor to take advantage of Superior’s existing infrastructure and transportation capabilities.

The company plans to use PEM electrolyzers that can ramp up and down more quickly with intermittent power from renewables, and is in talks with several of the major PEM manufacturers.