Ideanomics has been selected by Fenton Mobility Products as its partner to build five hydrogen-powered, zero-emission transit vans for the Rochester-Genesee Regional Transportation Authority, according to a news release.

The value of RGRTA’s order exceeds $2.2m. The cost of the buses is covered with funds from a $23m grant the RGRTA received from the U.S. Department of Transportation to deploy hydrogen fuel cell buses.

Under the terms of the agreement, Fenton Mobility will deliver a pilot hydrogen fuel cell battery electric-powered high-headroom van to the RGRTA. Once the pilot vehicle completes the FTA-mandated Altoona durability testing period and is shown to meet all requirements, production will commence on five additional vehicles to be delivered by 1Q24.

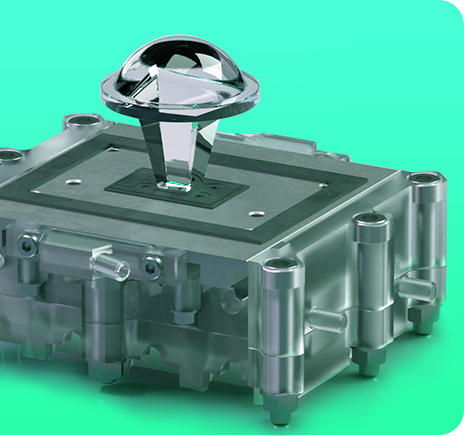

Ideanomics, through its subsidiary US Hybrid, will assemble the hydrogen fuel cell propulsion system and manufacture associated components at its engineering facility in Torrance, California. Fenton Mobility will install the hydrogen propulsion kit into the vans.

“Fenton is known for delivering the best solutions for public transportation, and Ideanomics has some of the best zero-emission products and technology,” Macy Neshati, Chief Commercial Officer at Ideanomics, said in the release.

New York State has set a goal for several transit systems across the state – including RGRTA – to fully transition their fleets to zero-emission by 2035. The state and RGRTA see hydrogen as an important clean energy solution to achieve these goals.

Ideanomics is part of a coalition to build zero-emission, hydrogen-powered shuttle buses, and has supplied hydrogen-powered buses to the County of Hawai’i Mass Transit Agency.