Gevo, Inc. announced today it has finalized and executed a Notice of Grant and Agreement Award with the U.S. Department of Agriculture (USDA) for a Partnerships for Climate-Smart Commodities grant of up to $30m for Gevo’s Climate-Smart Farm-to-Flight Program, according to a news release.

This program is aimed at tracking and quantifying the carbon-intensity (CI) impact of climate-smart practices while creating market incentives for low CI corn to help accelerate production of sustainable aviation fuel (SAF) and low-CI ethanol.

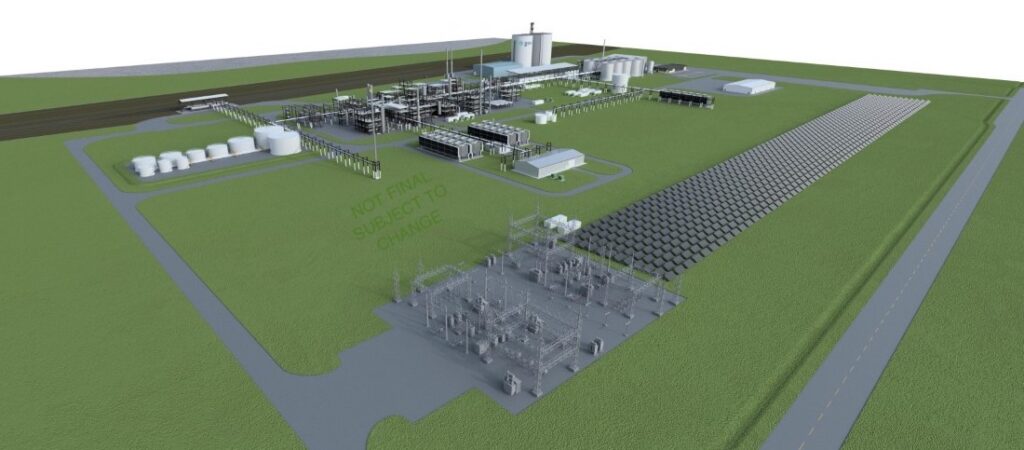

With the leadership and support of the USDA, we believe this grant will play a pivotal role in expediting the adoption of climate-smart farming practices and immediate market expansion of field-tracked, low-CI corn destined for SAF production in the area surrounding Gevo’s previously announced Net-Zero 1 (NZ1) SAF plant, currently under development in Lake Preston, South Dakota. The project will also accelerate the market adoption for climate-smart corn in close collaboration with Southwest Iowa Renewable Energy (SIRE), a dry-mill corn-based ethanol facility located near Council Bluffs, Iowa. An important part of the project is our aim to enroll majority female-owned farms in southeast Iowa and southeast Nebraska and Native American tribal organizations in South Dakota, including the Standing Rock Sioux Tribe.

“Our Farm-to-Flight Program, under this USDA grant, aims to count all the carbon at the field level and reward farmers on a performance basis for delivering low-CI corn, as well as to accelerate the production of SAF to reduce dependency on fossil-based fuel,” says Dr. Paul Bloom, Chief Carbon Officer and Chief Innovation Officer for Gevo, and Head of Verity. “The program will also focus on deploying our Verity Tracking platform with farmers to help them measure, report and verify their CI reductions.”

Gevo believes that the Argonne National Laboratory GREET model is the best available standard of scientific-based measurement for life cycle inventory or LCI. Verity, a Gevo program, uses the high-quality field and process level data, and the versatility of GREET to calculate the commodity’s carbon performance with a high degree of confidence that is traceable, immutable, and fully auditable. “The Verity carbon accounting platform will give us the ability to assign carbon-intensity scores to feedstocks on a field-by-field basis – creating financial grade climate smart commodities that carry their performance through the supply chain to the final biofuel products,” Bloom says. “This grant will help us apply the best science and reward growers for making a real difference to lower GHGs of biofuels.”

“When Net-Zero 1 and other production facilities come online, the feedstocks in the program will be a key to the equation,” says Dr. Patrick Gruber, CEO of Gevo. “This Partnerships for Climate-Smart Commodities grant will help ensure we count all the carbon through the entire business system and reward farmers for the good work they are doing.”