Norway-based Hexagon Composites CEO Jon Erik Engeset will step down as group president and chief executive officer.

The company will shortly commence a search process. Engeset will continue as CEO until the position is filled, following which he will continue to support the company in an advisory role, the company said in a news release.

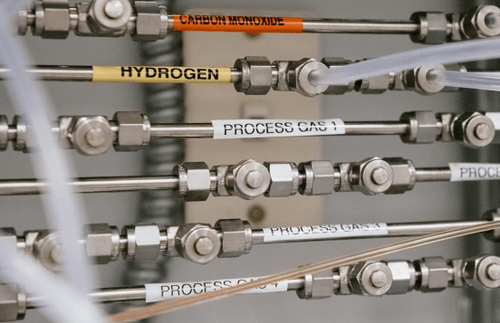

Hexagon Group is a global manufacturer of Type 4 composite cylinders used for storing gas under high-and low-pressure.