Schneider Electric, a provider of energy management and automation solutions, and Hy Stor Energy, a green hydrogen and long-duration storage developer, have signed a memorandum of understanding to support the development of Hy Stor Energy’s Mississippi Clean Hydrogen Hub and its broader U.S. development platform.

In this partnership, Schneider Electric and Hy Stor Energy are solving large-scale energy and sustainability challenges that are required to transition to a renewable and fossil-free energy system, according to a news release.

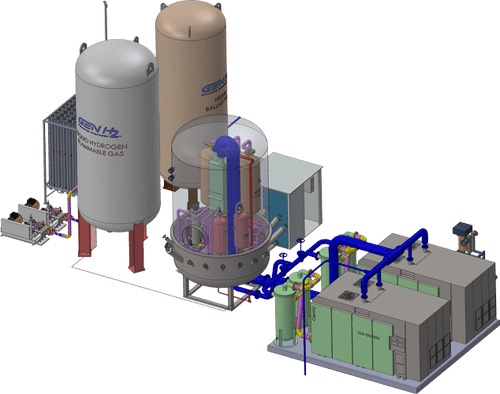

Under the terms of the MOU, Schneider Electric will provide Hy Stor Energy with automation and safety solutions, AVEVA process operation and AI optimization software, weather analysis, predictive operations, and digital energy management solutions, as well as commissioning, operational analytical tools, and support for those offers.

This project will advance Hy Stor Energy’s vision for the MCHH to be the first-of-its-kind in the world, providing reliable zero-carbon hydrogen to customers across a variety of industries. This new collaboration will offer Hy Stor Energy’s customers secure, reliable, and affordable green hydrogen with no carbon footprint or methane emissions.

Hy Stor Energy and Schneider Electric share common values in advancing sustainability in the new energy landscape by exploring intuitive solutions to address today’s energy challenges. In this agreement, Schneider Electric will be the main automation and electrical contractor, and partner for digital energy management and automation solutions for Hy Stor Energy’s operations. This solution is designed to deliver 100% carbon-free energy, providing customers with safe and reliable renewable energy on-demand.