Norwegian electrolyzer maker HydrogenPro today reported that it generated positive adjusted EBITDA in 4Q23.

The firm achieved a gross profit of NOK 56m for the quarter, for a 44% margin, and adjusted EBITDA of NOK 12m, representing a 10% margin.

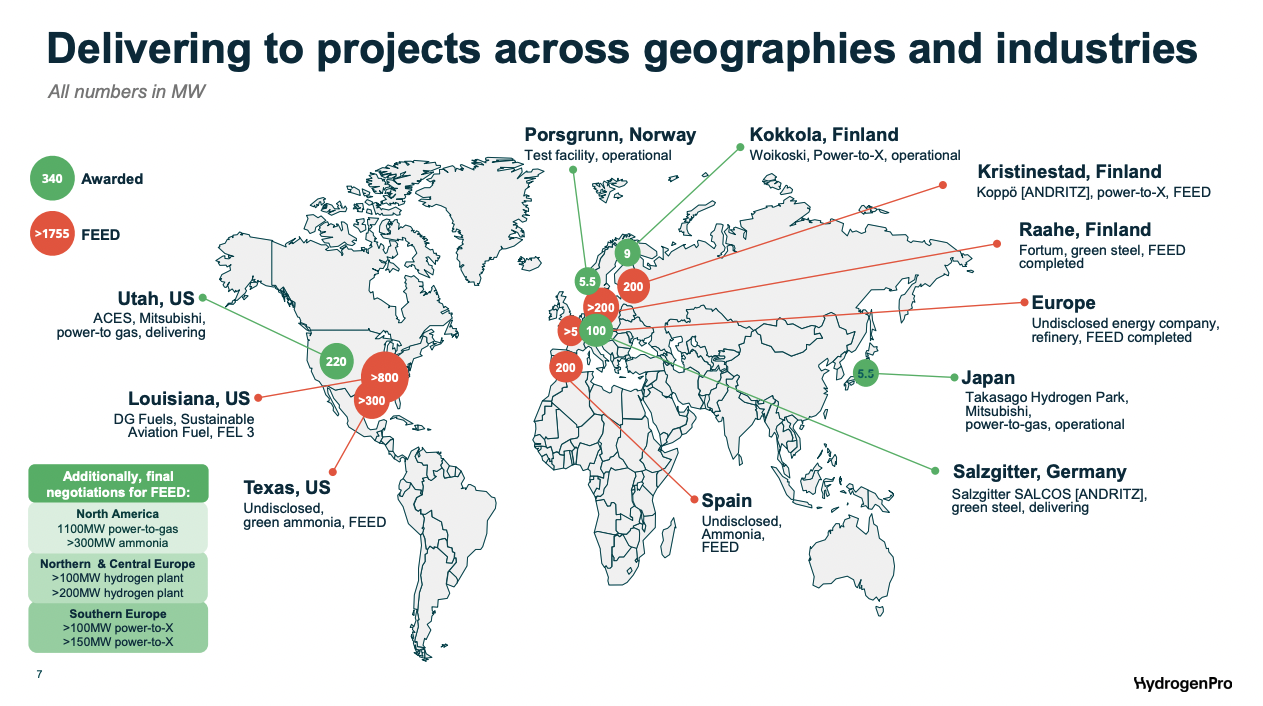

North America and Europe continue to be focal points for expected growth in green hydrogen projects, the company said in a presentation, but it has paused plans to advance with a factory that would have added 500 MW of capacity in Texas, due to uncertainty around 45V guidelines.

HydrogenPro recently completed manufacturing for the 220 MW ACES Delta project in Utah, and is now expecting its manufacturing load will decrease in early 2024, and is therefore ramping down capacity at its facility in China.

“Lessons learnt from project deliveries in the US has demonstrated challenges with regards to logistics and transportation of assembled electrolyzers and gas separator skids,” the company said in its earnings report. “This, in addition to the life cycle partner strategy of HydrogenPro indicates need for assembly stations in close proximity to customer sites. Moreover, further visibility on US legislative frameworks and funding schemes is needed, including insight into decision on requirement for local US content.”

The company has over 2 GW of North American project opportunities in its pipeline between 2024 and 2026, according to a presentation.

In its earnings release, HydrogenPro notes that it has sharpened its competitive edge by engaging in early-stage FEED studies, allowing it to move into the FEED study phase with project partners.

It further noted that it would reexamine both the location and manufacturing model under assessment for the Texas electrolyzer facility, suggesting it could take a more distributed approach to the location of end users.

“Given the recent market backdrop combined with the need for further regulatory clarifications in the US, the previously announced plan to establish a manufacturing facility in Texas is now put on hold as both location and manufacturing model being assessed, together with local supply chain,” the company said. “This does not alter the Company’s strong focus on the North American market. This market is a top priority to HydrogenPro, and the company plan to establish a strong footprint near customers with large projects, building a strong OEM position in the country.”