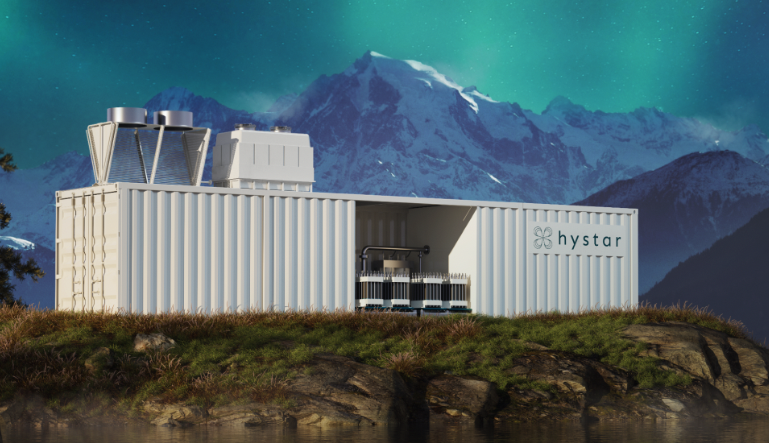

Norwegian electrolyzer maker Hystar is planning to expand into North America, establishing a headquarters next year and a multi-GW factory by 2027, according to a news release.

As part of its expansion, Hystar will soon initiate the hiring process for its new North American headquarters. Additionally, the company is in discussions with key stakeholders in both the United States and Canada to establish its first GW factory on the continent, where Hystar expects its commercial operations may exceed its European plans within the decade. The company has not ruled out the possibility of investing in further GW factories before 2030.

Hystar said in the same release it will deliver a fully automated 4 GW electrolyser factory in Høvik, Norway (just west of Oslo) by 2025, with construction commencing in early 2024.

The company earlier this year raised $26m in a Series B funding round co-led by AP Ventures and Mitsubishi Corporation. Additional investors in the round included Finindus, Nippon Steel Trading, Hillhouse Investment and Trustbridge Partners, alongside existing investors SINTEF Ventures and Firda.

Commenting on their expansion plans, Fredrik Mowill, CEO of Hystar, said: “Our Høvik GW factory demonstrates our commitment to rapidly expanding our European operations and meeting the strong demand for our technology across Europe. As we continue to scale up our operations, we are now looking at opportunities beyond Europe – the North American market has created a highly favourable environment for companies like ours to thrive in. We are looking forward to identifying the ideal North American location for Hystar.

Hystar has already commenced production of its electrolyzer stacks for its upcoming PEM electrolyzer deliveries using its existing facilities, which have a production capacity of 50 MW annually. As such, Hystar’s ramp-up to a GW factory marks a significant expansion to meet the surging demand for its breakthrough technology. The supplier for the Høvik GW automated production line will be selected later this year, and the factory’s production line will be fully operational by 2026.

Upcoming deliveries from Hystar include a 1 MW electrolyzer in Q4 2023 for Norwegian companies Equinor, Yara Clean Ammonia, and Gassco, for the HyPilot field project in Kårstø, Norway. This will be followed by a 5 MW electrolyzer for Poland’s largest private energy company, Polenergia, in Q3 2024 for their H2HubNS project in Nowa Sarzyna, Poland.