eFuels firm Infinium has reached an agreement with a subsidiary of midstream energy company Kinetik Holdings Inc. to purchase carbon dioxide captured from Kinetik’s gas gathering and processing system in the Permian Basin for use as a feedstock in the production of ultra-low carbon electrofuels, according to a news release.

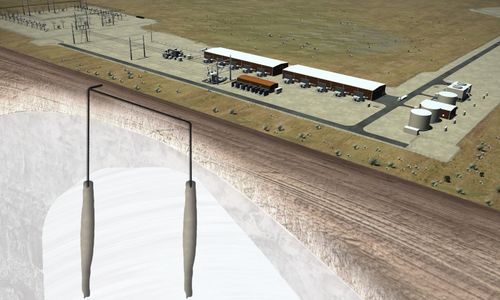

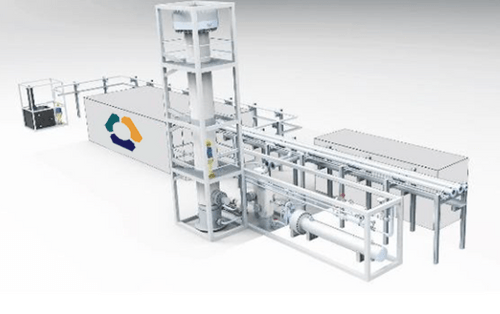

Infinium eFuels are created through a proprietary process using waste CO2 and green hydrogen derived from renewable power.

The agreement is unique in its long-term nature and broad decarbonization benefits, providing measurable impacts for transportation alternatives. It provides a model for the industry to rethink how to contract waste streams such as CO2 for use in solutions that provide beneficial reuse of emissions.

“There are many roles to be played in the energy transition, and this partnership shows that eFuels production and utilization is truly a win-win for all in the energy industry,” said Infinium CEO Robert Schuetzle. “It’s great to welcome Kinetik into our community of companies seeking beneficial reuse solutions for its CO2. The agreement demonstrates major progress and shows Kinetik’s leadership relative to the existing traditional oil and gas sector’s carbon emissions strategies.”

Under the terms of the agreement, a subsidiary of Kinetik will dedicate CO2 from one of its amine gas processing facilities in West Texas to Infinium for use at its previously announced second eFuels project called Project Roadrunner. Project Roadrunner will deliver products into both U.S. and international markets. It will primarily produce Infinium eSAF, a sustainable aviation fuel with the potential to significantly reduce the lifecycle greenhouse gas emissions associated with air transportation.

“Our partnership with Infinium reinforces Kinetik’s commitment to sustainability and our role as an agent for change. As the first step of Kinetik’s New Energy Ventures, I am excited to announce our participation in Project Roadrunner and strongly support Infinium’s mission to significantly reduce carbon emissions. Kinetik remains committed to further decarbonize our footprint and advance new low carbon technologies as part of our strategy of ‘energy for change,'” said Jamie Welch, Kinetik’s President and CEO.

Infinium previously announced a $75m equity commitment from Breakthrough Energy Catalyst for investment in Project Roadrunner, the first for the novel Bill Gates-founded platform that funds and invests in first-of-a-kind commercial projects for emerging climate technologies. American Airlines is the first announced offtake partner for eSAF produced at Project Roadrunner with emission reductions going to Citi, further modeling how long-term, innovative agreements contribute to decarbonization across multiple industries’ value chains.

Infinium operates the world’s first commercial scale eFuels facility in Corpus Christi, Texas and has more than a dozen projects in various stages of development globally.