The lender group for Fertiglobe’s 100 MW green ammonia project in Egypt is forming, so far without the presence of any commercial project finance banks.

Debt financing for the project, which is backed by a contract with H2 Global, an entity of the German government, is likely to come solely from international development banks, according to sources familiar with the project.

ADNOC-owned Fertiglobe will source green hydrogen from Egypt Green Hydrogen, a consortium between Fertiglobe, Scatec ASA, Orascom Construction, the Sovereign Fund of Egypt, and the Egyptian Electricity Transmission Company. The project, which also includes 270 MW of wind and solar power, is in the Suez Canal Economic Zone.

International development banks have so far committed to provide financing for the project, including the European Bank for Reconstruction and Development, European Investment Bank, Germany’s development finance institution and KfW subsidiary DEG, British International Investment, and US International Development Finance Corporation.

One might expect a clean energy project backed by a contract with the German government to attract a significant amount of interest from commercial banks seeking to lend into emerging sectors. It is, after all, an AAA-rated government entity that has been a leading proponent of climate policy globally, and this project would represent a major milestone in the green hydrogen industry.

But the novelties of the undertaking are such that project finance banks are still shying away from providing support, the sources said. Fertiglobe did not respond to emails seeking comment.

For one, there are questions around the overall bankability of the project, with a major obstacle coming in the form of the 10-year contract with Hintco. Under the agreement, the contract runs through 2033 – but the facility is still not constructed, and won’t be producing ammonia until 2027, effectively reducing the contract term to seven years.

The green hydrogen supply agreement between Egypt Green Hydrogen and Fertiglobe, in contrast, lasts for 20 years.

Hintco acknowledges this shortcoming in a presentation filed subsequent to the first auction results.

“The selected lot sizes (procurement volume) and contract term are “at the lower end” in the current market environment,” the presentation reads. “Bidders are focused on realizing economies of scale and offering marketable prices. The substantially larger lot sizes announced in the upcoming funding window address this obstacle.”

With regard to the contract size, the green ammonia production capacity of the project is 74,000 tons per year, but the contract only calls for 40,000 tons per year of imports, with an option to buy the rest. This amounts to the “smallest quantity possible” of volumes that can actually be banked as revenue, according to one of the sources: Even though there may be surplus revenue, the developers can’t bank on it because there’s no obligation to purchase it.

Additional provisions in the contract are proving to be commercially sensitive, such as the requirement for the ammonia to be delivered to Rotterdam, versus a typical freight-on-board commodity contract.

“It exposes a project to a lot of downstream logistics risk that many projects being developed are not looking to be exposed to and that lenders looking to finance a project in Egypt or wherever don’t want to be exposed to,” the source added.

Hintco also acknowledged this matter in its summation of the first auction. “Access to necessary port infrastructure is a challenge for many bidders,” it said.

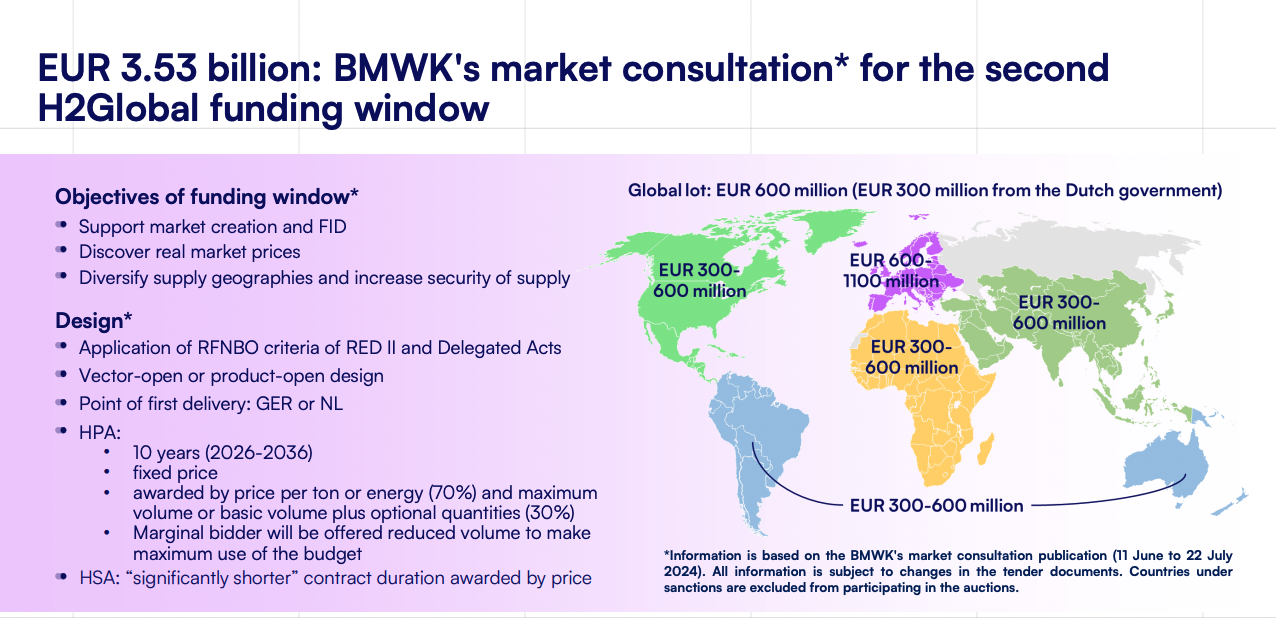

A second EUR 3.53bn H2 Global funding window is currently under market consultation, and is expected to result in additional 10-year contracts for vector-open green hydrogen, according to an H2 Global presentation: