Sanjiv Lamba, the CEO of global chemical company Linde, today re-emphasized his view that green hydrogen still has a roughly five to seven year runway to reach maturity for large-scale projects, noting that his company sees more near-term opportunity in blue hydrogen projects.

“We expect future US onsite clean hydrogen projects to primarily leverage 45Q credits” for carbon capture and sequestration, “since we have not yet identified any large onsite green hydrogen projects that meet our investment criteria,” the executive said.

“I expect to see small and mid-size green hydrogen projects primarily serve merchant-type demand,” Lamba added this morning on his company’s 4Q23 earnings call.

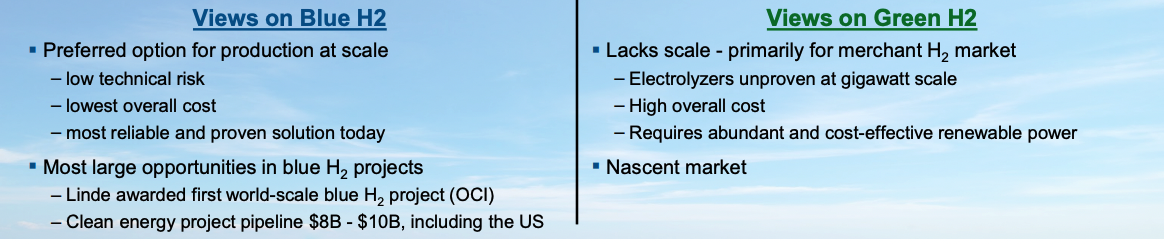

Linde included a slide in its earnings presentation noting that the nascent green hydrogen market lacks scale, underscoring that electrolyzers are unproven at gigawatt scale and have a high overall cost.

In contrast, most large pipeline opportunities are in blue hydrogen, and this remains the preferred option for Linde, given its low technical risk, lowest overall cost, and reliability, the presentation notes.

Electrolyzers need to gain reliability and the ability to operate 24/7 for onsite projects with a large demand pool, he said. Additionally, capital efficiency on electrolyzers needs to improve dramatically, “to make sure we’re at a point where that becomes cost effective.”

Lamba reiterated that he believes electrolyzer technology needs another five to seven years to scale up to achieve reliability and cost effectiveness for large-scale inflection to green hydrogen.

“I do expect small and medium-sized electrolyzer complexes to be built, and they will largely serve what we call merchant-type demand, where you have a bit of flex in terms of how much product is available, how much product is provided…”

In the meantime, Linde is developing its liquid hydrogen capabilities to support the smaller-scale green hydrogen projects it expects will be developed in the near term, he said.