Illinois Clean Fuels, the municipal solid waste solutions firm in Deerfield, Illinois, has mandated two advisors to run a capital raise, according to two sources familiar with the matter.

Chabina Energy Partners and Weild & Co. are assisting on the process, which the company plans to have finished by October, the sources said.

The equity will be put toward six recovery facilities to supply feedstock for an unannounced project located in the Chicagoland region, one of the sources said. Following two years or so of engineering and permitting, that project should enter construction.

In December or early 1Q24 ICF plans to launch another equity raise for development capital.

ICF, Chabina and Weild & Co. declined to comment.

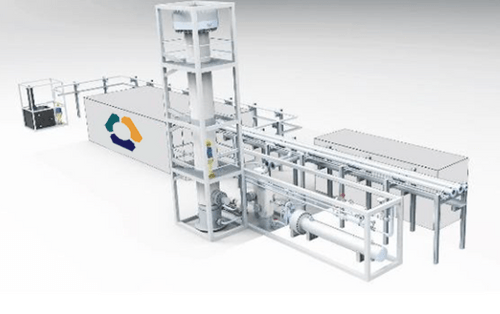

Illinois Clean Fuels has a synthetic fuel plant under development that will convert municipal solid waste into sustainable aviation fuel in combination with carbon capture and storage, according to its website.