NanoScent, an Israel-based technology firm, is seeking a new investor to help solidify an equity investment from the European Innovation Council, CEO Oren Gavriely said in an interview.

To satisfy the contingencies of a combined EUR 8m investment from existing investors and the EIC, NanoScent must bring on a new investor at EUR 2m, Gavriely said.

The ideal investor will have complementary capabilities that can ramp up the revenue stream, Gavriely added. Producers and suppliers of gasses and chemicals for industrial use would make sense.

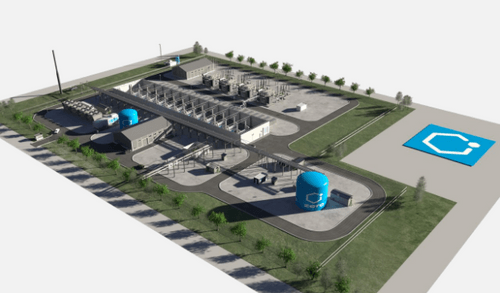

The money will be used to further develop the proprietary VOCID Purity in-line sensor controller, which measures hydrogen quality by monitoring the cleanliness of gas lines. The technology is oriented towards producers and end-users like fuel cell stations, who will be responsible for the integrity of the hydrogen. The product will be rolled out at the end of 1Q23.

Gavriely said the company has several customers for the technology in the pipeline, declining to say who they are.

NanoScent, founded five years ago, has raised USD 10m in equity to date, with another USD 10m in non-dilutive funding. The company’s largest outside investor is Sumitomo Chemical, which trades on the Tokyo Stock Exchange.

Control of the company is maintained by the founders, Gavriely said.

NanoScent has 20 employees, Gavriely said. So far the company has relied on the expertise of its board, which includes one former investment banker, for financial advisory services. That could change in the future as the company grows.

NanoScent uses Pearl Cohen for law services and EY for accounting.