Lakeview RNG, a wholly owned subsidiary of NEXT Renewable Fuels, has acquired assets associated with the Red Rock Biofuels development in Lake County, OR, according to a news release.

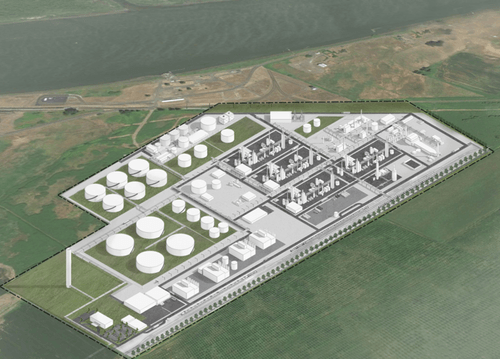

The company is commencing a redevelopment plan focused on completing construction of certain aspects of the site while replacing or enhancing others. When complete, the Lakeview RNG facility is expected to be capable of converting forest waste into renewable natural gas and clean hydrogen.

NEXT Renewable Fuels reached a deal to go public via a SPAC transaction with listed Industrial Tech Acquisitions II. A merger agreement for the deal, which was set to close on April 14, has been extended to December 14, according to SEC filings.

“Acquiring the Lake County clean fuels infrastructure is another advancement in our mission to decarbonize the transportation industry and produce low carbon fuels at scale,” said Christopher Efird, CEO and Chairperson of NEXT. “This acquisition represents a major step toward our clean fuel production capabilities and pathways to meet growing demand for clean fuels along the west coast of the United States while helping to address the critical concern of forest health.”

Using wood waste, or “slash,” as the feedstock, Lakeview RNG will process that wood waste and turn it into a low-carbon gaseous fuel, benefitting environmental and community health in southern Oregon and beyond.

Lakeview RNG has evaluated the potential feedstock supply in Oregon and determined that all of its wood waste needs could come from within 150 miles of the facility. Wood waste used at the facility will be certified and compliant with applicable regulations for RNG production. Converting forest waste to renewable fuel products helps reduce forest fire fuel loads and provide an additional revenue source to timber communities. The local distribution network in Lake County is anchored by the Ruby pipeline and can deliver renewable fuels to transportation markets in Oregon and along the west coast.

The purchase price of the facility has not been disclosed.