Synthica Energy has closed on a large equity investment from the Infrastructure Business within Goldman Sachs Asset Management, according to a news release.

ReSource reported last month that the company was in exclusivity with an investor.

The capital will be used for Synthica’s project development in Ohio, Texas, Georgia, Kentucky, and Louisiana in the near term, the release states. The Ohio-based company also plans to develop clean energy facilities in Florida, Illinois, Missouri, New York, and Pennsylvania.

Founded in 2017, Synthica aims to produce RNG from pre-consumer food and beverage waste and other organic manufacturing byproducts. The company’s business model focuses on processing pre-consumer organic waste instead of waste from farms or landfills.

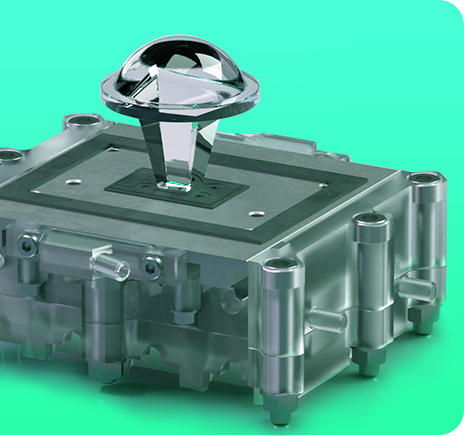

Synthica recently broke ground on its first facility in Ohio. The St. Bernard project, developed in partnership with UGI Energy Services, includes plans for a de-packaging system to process 190,000 tons per year of food and beverage waste.