PCC Hydrogen Inc, a low carbon/negative carbon hydrogen production company based in Louisville, KY, plans to construct a pilot hydrogen production plant in Cloverdale, IN, according to a news release.

PCC H2’s plant will showcase the efficient conversion of logistically friendly ethanol into high purity, negative carbon index green hydrogen using a patented reforming process coupled with the capture of the processes pure CO2 byproduct. By providing a readily available, negative carbon index hydrogen close to the point of need, the Company is enabling the decarbonization of the economy in a cost effective and commercially viable way.

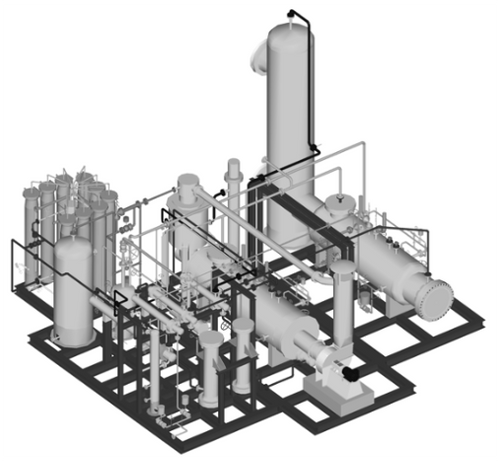

The Company has engaged Plant Process Group (PPG), a leading Houston based design, engineering, fabrication, construction, and commissioning services company to support the project with plans to have the pilot plant operational by first quarter 2024. PPG has decades of experience designing and building facilities for the refining industry, chemicals manufacturers, and biofuels producers.

PCC H2 is also working closely with the Town of Cloverdale and Putnam County to support the establishment of the first negative carbon index hydrogen production facility of its kind in the world. The production facility expects to hire local personnel at competitive wages and benefits.

Tim Fogarty, PCC H2 CEO, stated “We are excited to work with the Town of Cloverdale and Putnam County to showcase our groundbreaking technology. The Cloverdale location is ideal for the construction and operation of our first production facility given existing local hydrogen demand and the potential for broad adoption of low cost, negative carbon index hydrogen to help decarbonize the local economy in a financially rational way.”

Hydrogen generated from the PCC H2 process can be used in myriad applications ranging from hydrogen combustion engines to fuel cells (fuel cell powered loaders, trucks, other rolling stock, and for fuel cells in non-grid connected BEV charging stations). Furthermore, PCC H2 is exploring the use of its hydrogen to lower the emissions profile of any heating/calcining process. Finally, the Company is leveraging the logistically friendly nature of ethanol to produce hydrogen at smaller, distributed facilities closer to the point of use, diminishing the adverse added expense of transporting liquid hydrogen over long distances.

Cloverdale Town Manager, Jason Hartman, added “Cloverdale is extremely pleased to support the construction of the first of its kind negative carbon index hydrogen production plant that will decarbonize local industry while offering competitively priced jobs to the local community.”

The PCC H2 core reformer at the pilot plant will be mounted on three skids and operate 24/7. The company expects to break ground at the site this Summer.