Plug Power has signed an MOU with Allied Green Ammonia to supply up to 3 GW of electrolyzer capacity for AGA’s upcoming hydrogen-to-ammonia facility proposed for the Northern Territory of Australia, according to a press release.

Following the MOU, Plug and AGA plan to enter an agreement to initiate a Basic Engineering and Design Package for the project. The BEDP is expected to advance mid-May of this year, with final investment decision (FID) planned for 4Q25 and progressive delivery of the electrolyzer supply slated to begin in 1Q27.

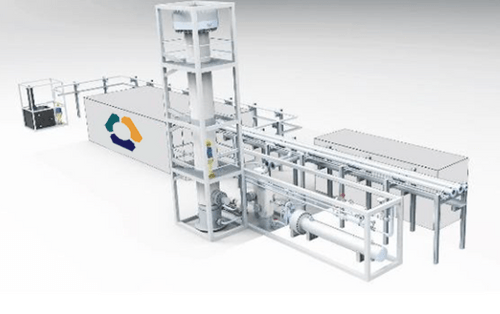

Green hydrogen produced by Plug’s electrolyzers can displace steam methane reforming (SMR). Plug’s pressurized (40 bar) electrolyzer decreases downstream compression and extracted oxygen can enhance efficiency in industrial power plants and furnaces.

AGA’s production facility will operate a 2500 mtpd green ammonia process. It taps into renewable energy resources and strong energy infrastructure, the proposed location Gove Peninsula aligning with Asia’s trading partnerships.