Red Trail Energy, LLC (RTE), and Puro.earth today announced issuance of RTE’s carbon dioxide (CO2) removal credits on the Puro Registry, making it the first ethanol production facility to generate CO2 Removal Certificates (CORCs) in the voluntary carbon market (VCM) and the largest durable carbon removal project registered to date.

RTE will be offering its CORCs through its marketing arm RPMG.

RTE worked with clean energy advisory firm EcoEngineers to successfully register its project under the Puro Standard, a crediting platform for engineered carbon removal, according to a news release.

The carbon dioxide removal (CDR) credits are generated through bioenergy with carbon capture and storage (BECCS) from ethanol production in compliance with Puro’s Geologically Stored Carbon Methodology. Prior to the issuance of CORCs, RTE underwent an independent verification and successfully met all requirements of feedstock sustainability, carbon sequestration permanence and financial additionality.

RTE sequesters CO2 from the fermentation process at its ethanol plant into a permitted underground Class VI well located approximately 6,500 feet directly beneath its facility. This carbon removal will be available as CORCs to help buyers complement their emission reduction activities in pursuit of net-zero targets.

“We have not only achieved a groundbreaking milestone as one of the first bioenergy facilities with BECCS but have also emerged as pioneers in bringing verified CDR credits to the market,” said Red Trail Energy Chief Executive Officer Jodi Johnson. “This program strengthens our position in the ethanol industry and sets a new standard for sustainability and innovation, driving positive change and demonstrating the viability of proactive environmental stewardship within our industry.”

Through Puro.earth and with EcoEngineers’ guidance, RTE was issued more than 150,000 CO2 Removal Certificates from the first 14 months of BECCS operation.

“Engineered carbon removal is in its infancy and there are a great many risks for project developers. The need for high-quality removals programs, such as RTE, is undisputed in the context of our overrun global carbon budgets and the imperative to reduce carbon emissions,” says David LaGreca, Managing Director of VCM Services at EcoEngineers. “The VCM serves in this case to provide producers optionality for markets and to reduce revenue risks through diversification, consequently making such projects investable in the first place.”

Antti Vihavainen, Chief Executive Officer of Puro.earth, said, “This is the largest durable carbon removal credit issuance to date in the VCM, marking a monumental milestone toward scaling CDR to climate-relevant levels. At Puro.earth, we remain steadfast in our commitment to establishing rigorous standards that propel the expansion, commoditization, and liquidity of durable CDR markets. The significance of RTE’s CCS project cannot be overstated, as it serves as a compelling demonstration that through stringent methodologies for carbon removal and the financial incentives from CORCs, the vital infrastructure required for large-scale carbon sequestration will materialize.”

The Puro.earth-issued CORCs indicate 1,000-plus years of carbon sequestration durability, which provides the key environmental criteria of permanence. For traceability and transparency, CORCs are listed in the International Carbon Reduction and Offset Alliance (ICROA)-endorsed Puro Registry where their complete lifecycle is recorded, from issuance to retirement.

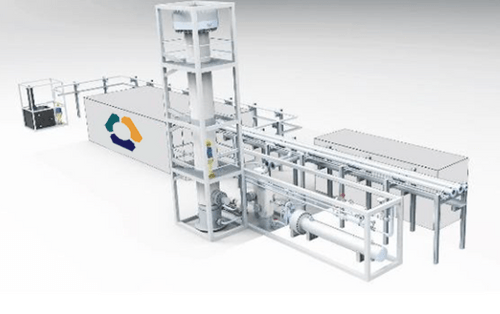

RTE is a 64 million-gallon-per-year corn ethanol production facility that captures and stores biogenic CO2 from its ethanol fermentation process. The first facility permitted under state primacy to capture and store CO2 in a Class VI well, with an estimated annual output of 180,000 tons. RTE captures the biogenic CO2, which would otherwise be vented into the atmosphere, and injects it for permanent storage into an underground Class VI well beneath its facility. RTE has continuous efforts in place to ensure that the fossil footprint of their main product, biofuel, is reduced through energy efficiency measures and reasonable agricultural practices.

CORCs generated in accordance with rigorous scientific and market requirements, including additionality and permanence, may supplement other incentives. RTE made an additional investment in first of its kind application of proven technology infrastructure to capture and inject the CO2 considering future revenue from carbon removal credits. CO2 Removal Certificate sales in voluntary markets are necessary to support building out CCS projects while reducing carbon removal project financial risks.