The Biden administration’s goal of reaching 3 billion gallons of SAF production by 2030 under the SAF Grand Challenge is within reach but could be hindered by policy shortcomings, according to a report from CoBank.

A lack of long-term incentives, better subsidies for renewable diesel production, and delays in guidance for 45Z clean fuel tax credits and its implementation, among other policy matters, could limit growth in the emerging sector, Jacqui Fatka, lead economist for Farm Supply and Biofuels, wrote in the report.

The Inflation Reduction Act’s 45Z tax credit, designed to support clean fuel production, is limited to three years beginning in 2025. This short-term scope may not provide enough stability for investors to commit to long-term SAF production, as they often seek at least a decade of certainty to justify capital investments.

The GREET (Greenhouse gases, Regulated Emissions, and Energy use in Technologies) model update, essential for calculating carbon intensity (CI) scores, faces delays that add uncertainty for farmers preparing for the 2025 crop year., the report notes. Moreover, shifting federal administration priorities could delay other crucial policies, like the Renewable Volume Obligation (RVO) updates, due in November 2024 but now potentially postponed until 2025.

The EPA’s RVO mandate in 2023 was set below the sector’s actual production and import capacities, the report notes. A study from S&P Global Insights found that in 2023 alone, domestic and imported feedstocks supported the production of 4.3 billion gallons of renewable diesel and biodiesel, surpassing the yearly RVO targets for 2023, 2024, and 2025.

“EPA is statutorily obligated to propose 2026 levels by November of 2024; however, the Biden administration’s regulatory agenda indicated it would delay publication until March 2025,” the report says. “A change in leadership at the White House after the November election could further delay publishing the proposal for the next RVO rule.”

SAF production requires higher operational intensity and hydrogen use, raising costs and emissions relative to RD. Without favorable incentives or airline commitments to offset these costs, RD producers remain inclined to prioritize renewable diesel, where profitability is higher due to stronger incentives.

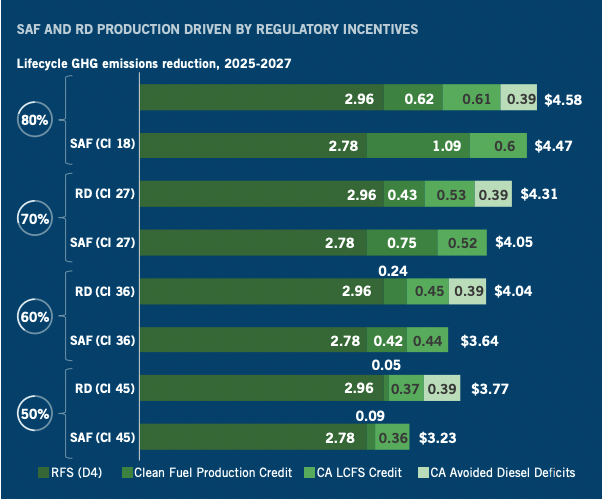

In particular, the incentive for California Avoided Diesel Benefits makes RD production more favorable at every CI score, the report says, citing data from NREL (pictured).

Airlines’ reluctance to engage in long-term offtake agreements exacerbates financing challenges for SAF projects, the report notes. Shorter agreements (often less than three years) create revenue uncertainty for SAF producers, deterring investment. Airlines are concerned that higher SAF costs could harm their competitiveness if not balanced by incentives.

The cost of SAF production ranges from $6.40 to $19.01 per gallon, with HEFA on the lower end and alcohol-to-jet the higher end. Airlines have shown a willingness to pay $6 per gallon, up from the conventional fuel price of $2.294 . If airline companies lock in longterm sustainable aviation fuel at a higher cost for substantial amounts of their fuel, it could make them uncompetitive against their peers.”

Meanwhile, current tax credits and carbon intensity reductions, like the 40B credit, inadequately reward farmers for implementing climate-smart practices. While the 45Z tax credit promises more benefits, its guidelines remain delayed, leaving farmers uncertain about future revenue streams linked to SAF feedstocks.

In addition, imported feedstocks with lower CI scores, like used cooking oil and tallow, compete against domestic oils (e.g., soybean oil), impacting local feedstock producers. Furthermore, doubts about the authenticity of imported feedstocks, particularly from countries like China, add regulatory challenges and potential disruptions in supply reliability.