The Canada Growth Fund has formed a strategic partnership with Strathcona Resources to build carbon capture and sequestration (CCS) infrastructure on Strathcona’s steam-assisted gravity drainage (SAGD) oil sands facilities across Saskatchewan and Alberta, according to a news release.

Through the SAGD CCS Partnership Strathcona will seek to capture and permanently store up to two million tons of CO2 annually, with CGF and Strathcona each contributing up to $1bn in project funding.

Stikeman Elliott and Sproule International Limited acted as advisors to Canada Growth Fund. Blake, Cassels & Graydon served as legal counsel to Strathcona.

Strathcona is the fifth largest oil producer in Canada, with production-related emissions (Scope 1 and 2) of approximately 3 million tonnes of CO2 per annum from seven major oil sands facilities.

Under the terms of the SAGD CCS Partnership, CGF and Strathcona will each fund 50% of the capital costs to build CCS infrastructure on Strathcona’s oil sands facilities. CGF will initially commit $500m in project funding with the option to upsize its commitment to $1bn.

Strathcona will build, own and operate all CCS projects and receive all investment tax credits. CGF will earn a targeted return over time with the annual cash flows generated by each CCS project based on actual captured volumes, actual operating costs, and a fixed carbon price guaranteed by Strathcona. Each CCS project’s fixed price per tonne will be set at the time of FID.

The SAGD CCS Partnership represents a first-of-its-kind approach to CCS risk-sharing, with the emitter retaining carbon pricing risk and CGF sharing in the risk for the project’s cost and capture efficiency. The SAGD CCS Partnership is expected to enhance the long-term competitiveness of one of Canada’s most carbon-intensive industries by advancing large-scale commercial CCS projects over time and demonstrating decarbonization outcomes in a fiscally prudent manner.

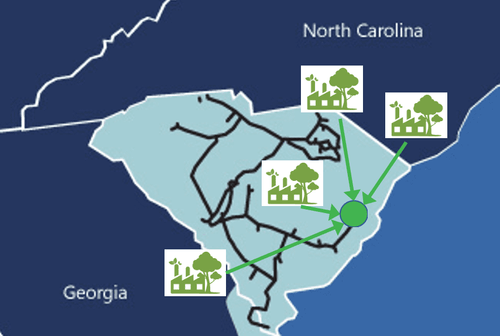

Strathcona’s oil sands facilities in Lloydminster and Cold Lake are located near suitable CO2 storage reservoirs, allowing for CO2 to be injected directly on site. Over the past three years, Strathcona has made significant progress in bringing its first CCS project to FID.

In 2024, the Government of Saskatchewan granted Strathcona subsurface CO2 injection rights, making Strathcona the first oil sands producer in Canada with approval to capture and permanently store CO2. The SAGD CCS Partnership will allow Strathcona to begin its final detailed engineering work with a targeted FID date in mid 2025 for its first commercial CCS project which is expected to be in Saskatchewan. Strathcona is in dialogue with the province of Alberta regarding an approval for dedicated sequestration pore space beneath its Cold Lake properties.

In keeping with its mandate, CGF is focused on enabling substantial, cost-efficient emission reductions and supporting the commercial-scale operations of technologies crucial to decarbonizing Canada’s hard to abate industries. Given financial institutions are generally not yet comfortable underwriting CCS project-specific risks, CGF is enabling investments in an important sector not yet well served by commercial lenders.

“This partnership is a breakthrough in Canada’s journey towards decarbonizing the oil and gas sector,” said Patrick Charbonneau, President & CEO of CGF Investment Management. “Alongside CGF, Strathcona intends to advance Canada’s first CCS projects in the heavy oil sector. Given the economic and environmental importance of the oil and gas sector–which represents 9% of Canada’s nominal GDP and 31% of its emissions–Strathcona’s leadership is essential and worth celebrating.”

“Strathcona is proud to be leading the Canadian oil and gas sector towards reducing our carbon intensity, prudently and profitably,” added Adam Waterous, Executive Chairman of Strathcona. “We hope this innovative partnership with CGF will serve as a template for other producers and serve notice to the global oil and gas industry that Canada not only has one of the largest and most profitable oil resources in the world, but soon through these CCS projects, on a path toward becoming the least carbon intensive.”