Sumitomo Corporation, through the Group’s U.S.-based Presidio Ventures, Inc., has announced its investment in Global Thermostat, PBC, a U.S.-based company that develops and deploys a leading technology for directly capturing carbon dioxide from the atmosphere, according to a news release.

In conjunction with the investment, the companies have signed a letter of intent to develop a new line of global business for carbon capture and sequestration centered around Global Thermostat’s pioneering Direct Air Capture (DAC) technology.

DAC technology directly captures CO2 from the atmosphere and has attracted attention as one of the leading potential solutions for achieving negative emissions on a large scale. When used in combination with underground storage or mineralization solutions, it is likely to have a key role in reducing atmospheric carbon dioxide.

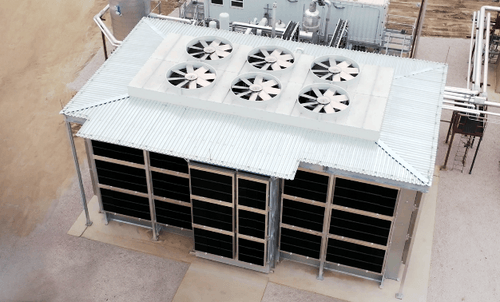

Global Thermostat has been developing DAC technology for more than a decade and has been recognized by the International Energy Agency (IEA) as one of the leading international companies developing large-scale DAC technology. In continually advancing its capture system, the firm has developed a proprietary solution consisting of fans which blow air through contactors with customized surface geometry and sorbents to optimize CO2 capture rates and overall cost.

At the end of 2022, Global Thermostat succeeded in putting a commercial-scale DAC facility into operation at its U.S. headquarters in Commerce City, Colorado, with the capacity to capture more than 1,000 metric tons of CO2 per year, one of the largest operating DAC plants ever. It is now expanding its operations globally.By combining Sumitomo Corporation’s global network and Global Thermostat’s leading DAC technology, the two companies will jointly identify and develop business opportunities in Carbon Capture, Utilization, and Storage (CCUS), including both underground storage and mineralization, in the U.S., Europe, Middle East and Asia markets.

The capturing and sequestration of atmospheric carbon is widely recognized as essential to keeping the global temperature rise below the 1.5 degree target. Together, Sumitomo and Global Thermostat aspire to establish a complete economic system that will provide a foundation for the widespread, global implementation of Direct Air Capture.

In developing the carbon capture value chain, Sumitomo Corporation and Global Thermostat will also explore opportunities in the production of e-fuels, produced by synthesizing CO2 and hydrogen.

“We are excited to be Sumitomo’s technology partner as we pursue our goal of a carbon-neutral economy. Our proven and fundamentally advantaged technology will enable the cost-effective and efficient capturing of atmospheric CO2 for sequestration or commercial uses,” said Paul Nahi, CEO of Global Thermostat.

Shinichi “Sandro” Hasegawa, Head of Energy Innovation Initiative America for Sumitomo Corporation of Americas, commented, “We are pleased to sign a letter of intent for a commercial partnership with Global Thermostat. We believe that DAC is one of the most important technologies for addressing climate change and the realization of a carbon-neutral society.

“Through our collaboration with Global Thermostat, we will promote and realize carbon dioxide removal from ambient air through Direct Air Capture with Carbon Storage, as well as focus on synthetic fuel production based on the captured CO2,” said Hasegawa.