United Airlines has launched the United Airlines Ventures Sustainable Flight Fund to support start-ups focused on decarbonizing air travel, according to a press release.

The fund starts with more than $100m in investments from United and inaugural partners Air Canada, Boeing, GE Aerospace, JPMorgan Chase, and Honeywell to invest in SAF technology and production start-ups identified by United. Customers buying a ticket on the United website or app will also have the option to contribute to the fund.

The Sustainable Flight Fund is open to investment by corporations across industries and will prioritize investment in new technology, advanced fuel sources and proven producers.

“Partners of the fund also have the potential to gain preferential access to environmental attributes associated with United’s supply of SAF,” the release states.

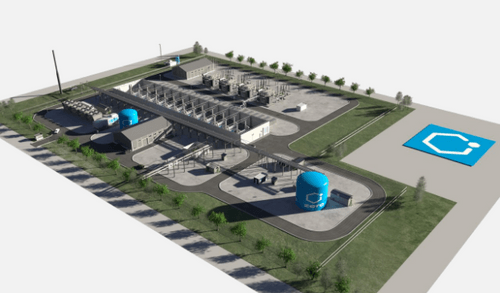

In the past two years UAV has invested in start-ups such as Cemvita, Dimensional Energy, and NEXT Renewable Fuels.