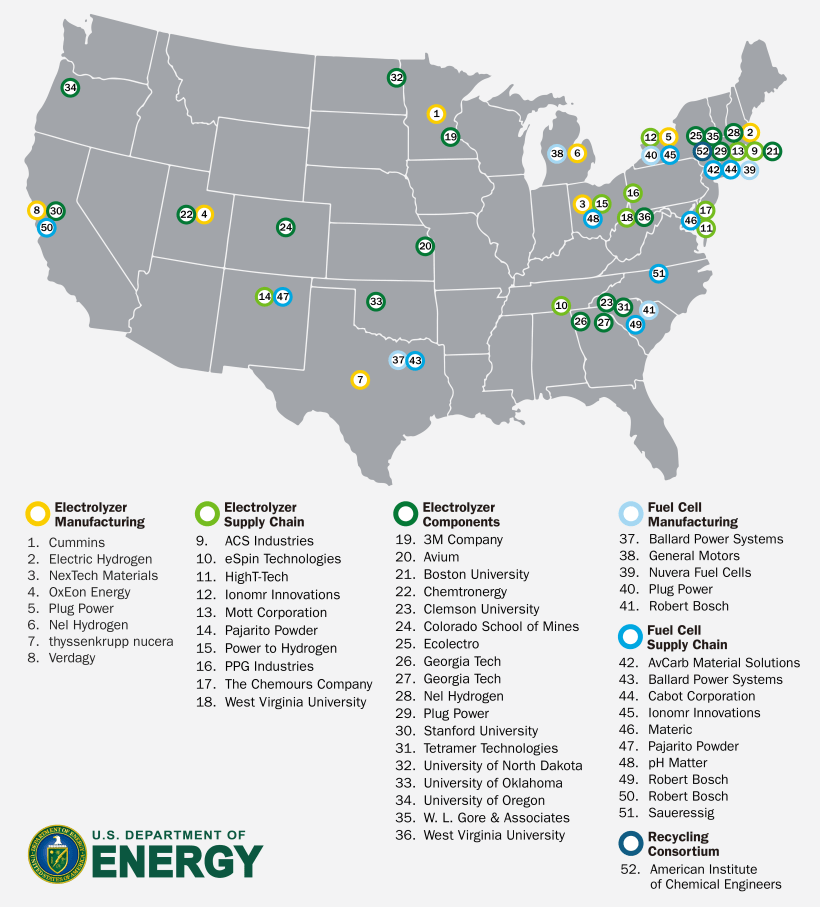

Electrolyzer manufacturers Nel ASA, thyssenkrupp nucera, and Electric Hydrogen are among the biggest recipients of funding from the Department of Energy’s $750m funding disbursement for 52 projects across 24 states to reduce the cost of clean hydrogen.

Additional electrolyzer makers Plug Power, Verdagy, OxEon, NexTech Materials, and Cummins were also selected to receive funding.

Learn more about the projects selected for award negotiations here.

The projects are expected to enable U.S. manufacturing capacity to produce 14 gigawatts of fuel cells per year, enough to power 15% of medium- and heavy-duty trucks sold each year, and 10 gigawatts of electrolyzers per year, enough to produce an additional 1.3 million tons of clean hydrogen per year, according to a news release.

Managed by DOE’s Hydrogen and Fuel Cell Technologies Office (HFTO), these projects represent the first phase of implementation of two provisions of the Bipartisan Infrastructure Law, which authorizes $1 billion for research, development, demonstration, and deployment (RDD&D) activities to reduce the cost of clean hydrogen produced via electrolysis and $500 million for research, development, and demonstration (RD&D) of improved processes and technologies for manufacturing and recycling clean hydrogen systems and materials.

Selected projects will advance clean hydrogen technologies in the following areas:

- Low-Cost, High-Throughput Electrolyzer Manufacturing (8 projects, $316 million): Selected projects will conduct RD&D to enable greater economies of scale through manufacturing innovations, including automated manufacturing processes; design for processability and scale-up; quality control methods to maintain electrolyzer performance and durability; reduced critical mineral loadings; and design for end-of-life recovery and recyclability.

- Electrolyzer Component and Supply Chain Development (10 projects, $81 million): Selected projects will support the U.S. supply chain manufacturing and development needs of key electrolyzer components, including catalysts, membranes, and porous transport layers.

- Advanced Technology and Component Development (18 projects, $72 million): Selected projects will demonstrate novel materials, components, and designs for electrolyzers that meet performance, lifetime, and cost metrics—to enable cost reductions and mitigate supply chain risks. Longer-term cost reductions enabled by these cutting-edge projects are likely to play a significant role in achieving DOE’s Hydrogen Shot goal.

- Advanced Manufacturing of Fuel Cell Assemblies and Stacks (5 projects, $150 million): Selected projects will support high-throughput manufacturing of low-cost fuel cells in the United States by conducting RD&D that will enable diverse fuel cell manufacturer and supplier teams to flexibly address their greatest scale-up challenges and achieve economies of scale.

- Fuel Cell Supply Chain Development (10 projects, $82 million): Selected projects will conduct R&D to address critical deficiencies in the domestic supply chain for fuel cell materials and components and develop advanced technologies that reduce or eliminate the need for per- and polyfluoroalkyl substances (PFAS), often referred to as “forever chemicals.”

- Recovery and Recycling Consortium (1 project, $50 million): This funding establishes a consortium of industry, academia, and national labs to develop innovative and practical approaches to enable the recovery, recycling, and reuse of clean hydrogen materials and components. It will establish a blueprint across the industry for recycling, securing long-term supply chain security and environmental sustainability.