Visolis, a California-based sustainable materials company, has formed a partnership with cell programming and biosecurity firm Ginkgo Bioworks to reach commercial production of a key feedstock ingredient used to make bio-based isoprene and SAF, according to a news release.

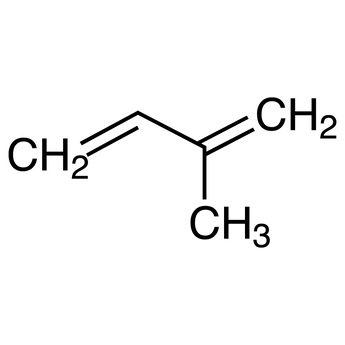

Isoprene is a monomer used for commercial scale synthetic rubber production.

“Achieving the production of bio-based isoprene at scale represents a significant step toward decarbonizing tire manufacturing,” the release states. “Isoprene can also be used as an intermediate for high performance, lower carbon intensity sustainable aviation fuel (SAF) production.”

Achieving bio-based isoprene production at scale is difficult because the molecule is highly volatile and combustible.

“Visolis has developed a novel process by using a more stable intermediate, making isoprene through a two-step manufacturing process and enabling more efficient and reliable production,” the release states. “Through the partnership with Ginkgo, the two companies are working to further optimize the efficiency of this biomanufacturing process.”