Norwegian ammonia player Yara is forging ahead with blue ammonia projects in the United States even as others drop off, taking the view that an upstream presence here can help drive value creation across its global platform.

Executives from the firm today stressed the opportunities to build natural gas-fed ammonia plants with carbon capture and storage as a means of accessing lower cash cost ammonia – and to take advantage of higher margins in Europe under CBAM.

The company expects EU carbon penalties to increase prices for nitrogen in Europe, with higher margins for nitrate and NPK fertilizers when upgraded from low-carbon ammonia.

“Switching to production in the US, we get access to competitive gas pricing and also well advanced CCS infrastructure,” CEO Svein Tore Holsether said today. “Furthermore, with the large scale, we can significantly reduce our capex per ton.”

Most importantly, the executive added, Yara has internal offtake for those volumes from its European premium product plants – in addition to growing external demand from new clean ammonia markets.

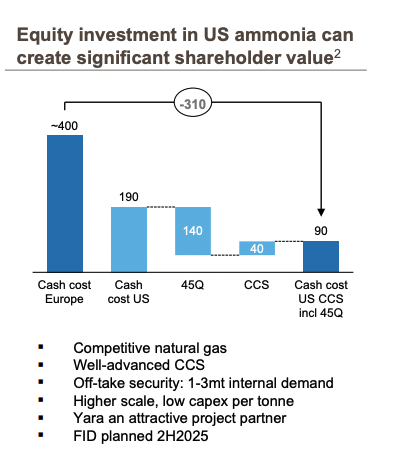

A slide included in today’s presentation shows that Yara could theoretically achieve a cash cost of $90 per ton of clean ammonia in the U.S., compared to $400 per ton in Europe.

Yara and Enbridge announced a letter of intent in March 2023 to jointly develop and construct a blue ammonia production facility as equal partners. The proposed production and export facility, which includes autothermal reforming with carbon capture, will be located at the Enbridge Ingleside Energy Center, near Corpus Christi, Texas.

A website for the project states that developers will file permit applications for two production units, with a total capacity of up to 2.8 million metric tons of ammonia per year.

The original announcement for the project said it would cost between $2.6–$2.9bn.

According to local news reports, an “objectionable use” permit for the facility was denied in a January 16th, 2024 Ingleside city council proceeding.

Yara has also announced arrangements with JERA and BASF to explore blue ammonia production on the Gulf Coast.

The company is still targeting 2H25 for FID on the U.S. projects, Holsether said today. He added that Yara would not sanction the projects unless they promise a double-digit return.