Fusion Fuel, a green hydrogen developer based in Portugal, has engaged an advisor and is in talks with investors to raise capital for projects in North America.

The company is working with RBC Capital Markets as financial advisor, Fusion Fuel Co-Head Zachary Steele said in an interview, and expects to produce infrastructure-type returns on its projects.

For its first project in the U.S., Fusion Fuel has agreed to a JV with Electus Energy to build a 75 MW solar-to-hydrogen facility in Bakersfield, California.

The project will produce up to 9,300 tons of green hydrogen per annum including nighttime operation and require an estimated $180m in capital investment, with a final investment decision expected in early 2024 and commissioning in the first half of 2025.

The combination of green hydrogen and solar production incentives along with California’s low carbon fuel standard make the economics of the project attractive, Steele said.

“Hydrogen is selling for up to $15-$18 per kilogram in California in the mobility market, and we can produce it at around the low $3 per kilogram area, so that leaves a lot of room for us to make a return and reduce costs for customers,” he said.

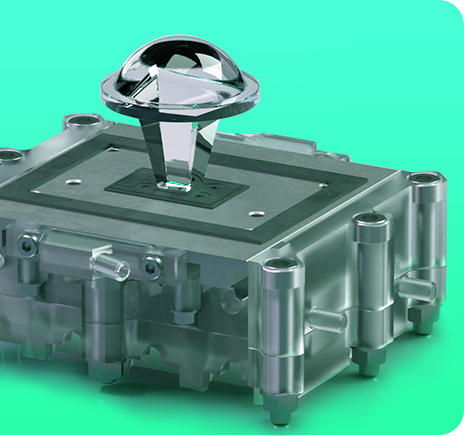

The company sells electrolyzer technology for projects but also serves as a turnkey developer. The technology consists of Hevo-Solar, which utilizes concentrated solar power to create hydrogen; and Hevo-Chain, a centralized PEM electrolyzer powered by external electricity.

Fusion Fuel’s proposition is that its smaller-scale technology – of 25 kW per unit – is ready to use now, and can be dropped into places like a gas station in New York City, Steele said.

“This allows customers to scale into hydrogen and makes it available on site, compared with the massive projects going up in Eastern Canada or the Gulf Coast that require customers to commit significant capital to underwrite large scale projects,” he added.

Along with Electus, Fusion Fuel has already entered into a land-lease agreement for 320 acres in Kern County, California for the Bakersfield development. Black & Veatch will perform a concept study while Cornerstone Engineering and Headwaters Solutions are also engaged.

Iberian pipeline

The company targets to have EUR 40m of revenues in 2023, with a third of that coming from tech sales and the balance coming from Fusion Fuel-owned development projects.

Its revenue pipeline for next year is focused on the Iberian peninsula, and has been largely de-risked with the company having secured grants, with land and permitting underway.

In addition to the electrolyzer sales, the company, together with its partners, can provide turnkey projects that include engineering, procurement of the balance of plant equipment, construction of the facility, and operations, Steele said on an investor call this week.

“This allows us to not only make returns on the tech sale but also on the overall project and potentially recurring revenue from operations,” he said.

The company plans to use projects it is building in Portugal to expand into other core markets, beginning with a focus on mobility opportunities and targeted industrial decarbonization projects. Starting in 2024 the company plans to extend its reach further into North America and also Italy.

U.S. focus

Similar to other international hydrogen players, the passage of the Inflation Reduction Act caused a strategic shift of focus to the U.S. and accelerated Fusion Fuel’s plans to grow its business there, company executives said.

Notably, since Fusion Fuel will use its own technology in the projects it is seeking to develop, a required amount of that technology will need to be manufactured in the U.S. in order to qualify for the full benefits provided in the IRA.

As such, Fusion Fuel is scouting for a location to build one, or possibly two, manufacturing facilities in the U.S.

“The size of the Bakersfield project alone justifies building a new manufacturing facility,” Steele said on the investor call.

Steele was previously CEO of Cedar LNG, a floating LNG development in British Columbia, prior to exiting to Pembina. He works alongside Fusion Fuels Co-Head & CFO, Frederico Figueira de Chaves, who is based in Portugal.