Enviva, the US-based producer of woody biomass, has received a construction permit from the Alabama Department of Environmental Management (ADEM) for its Epes biomass production plant under construction in Sumter County, according to a news release.

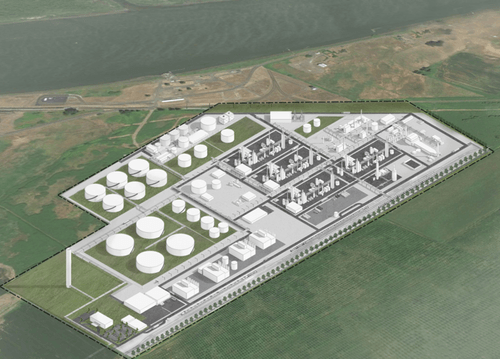

The revised permit enables Enviva to build a state-of-the-art sustainable biomass production facility at a brownfield site in the town of Epes.

In 2020 Enviva acquired over 300 acres of land on the coast of the Tombigbee River in Sumter County for the plant. The site was formerly home to a wood products manufacturing company.

Enviva started preliminary construction of the fully contracted Epes plant in July 2022. The plant is expected to have a nameplate capacity of 1.1 million metric tons per year and is expected to be in service in 2024 and fully ramped in 2025.