Buckeye Partners has closed on the acquisition of Bear Head Energy, Inc., according to a news release.

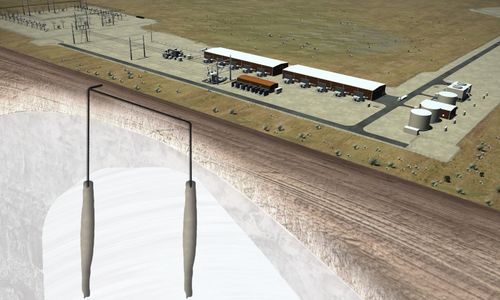

Bear Head is developing a large-scale green hydrogen and ammonia production, storage and export project in Point Tupper, Nova Scotia with hydrogen electrolyzer capacity of more than 2 GW.

As part of the project’s phased development, Buckeye plans to partner with on-shore and off-shore renewable energy developers to build out a large-scale green hydrogen hub for Atlantic Canada.

Buckeye established its Alternative Energy operating segment as a clean energy business that focuses on the development, construction, and operation of alternative energy projects, including hydrogen, wind, and solar-powered energy solutions.