First quarter results for Calumet’s SAF operations, known as Montana Renewables, are expected to reflect the significant burden of higher priced feedstock purchased prior to the summer 2023 slowdown related to a steam system issue. Entering the second quarter of 2024, the old, expensive feedstock has been processed, the company said in a news release.

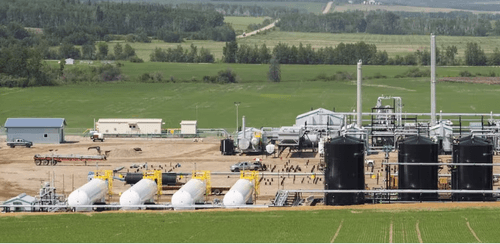

Montana Renewables (MRL) resumed production at its Great Falls, MT, site in December 2023.

The site operated well throughout the first quarter of 2024 as volumes sequentially improved each month.

Further, first quarter 2024 results will reflect a planned turnaround at our Shreveport site in March, which was completed on time and on budget. We begin the second quarter of 2024 at Shreveport with solid operating momentum. In the first quarter of 2024, we were negatively impacted by seasonal weakness in our fuels and asphalt products, particularly in PADD IV.

“A year after commissioning began, our Montana Renewables business is now consistently processing approximately 12,000 barrels per day of renewable feedstock, including over 10,000 barrels per day of feed from our next generation feed pretreater,” said Todd Borgmann, CEO of Calumet. “With these key operational milestones now reached, stable operations have allowed us to process an overhang of old expensive feedstock inventory. Given this progress, we are optimistic that we will achieve representative financial performance at Montana Renewables going forward, clearly demonstrating the strong competitive position of the business. Our advantaged feed and technology positions are complemented by agile product marketing and our position as the largest producer of sustainable aviation fuel in the Western Hemisphere, with current production levels running at a 30 million gallon per year pace. Significant further expansion of SAF production remains a strategic priority, and we remain encouraged by the well-advanced DOE loan program discussions.

“This operational progress supports our strategy of two competitively advantaged businesses, both of which are expected to generate cash toward our deleveraging strategy. We also continue to track towards a second quarter conversion of Calumet into a C-Corp, substantially widening our potential investor base. We believe that the culmination of all these actions should allow us to create substantial shareholder value.”